Blockchain Fork Explorer

Explore the different types of blockchain forks and their characteristics.

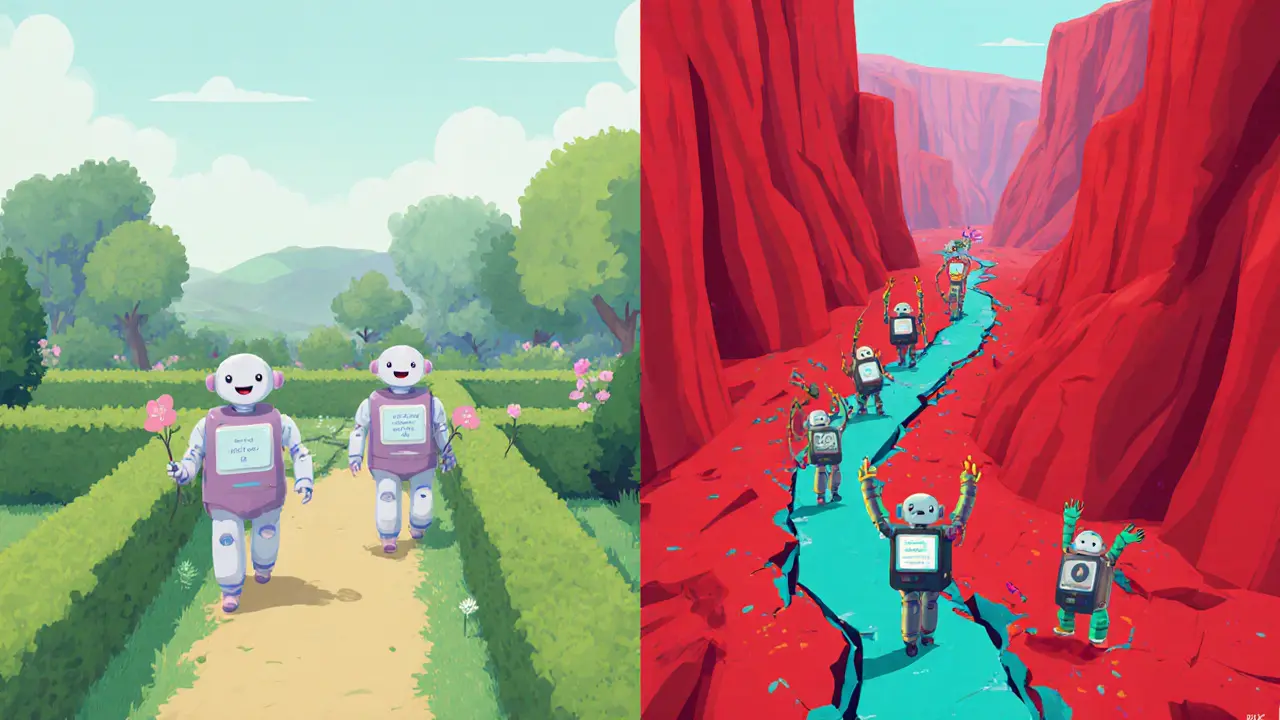

Soft Fork

Backward Compatible

Old nodes still recognize new blocks as valid. Creates no new coin.

Hard Fork

Not Backward Compatible

Creates a new blockchain and potentially a new token.

| Aspect | Soft Fork | Hard Fork |

|---|---|---|

| Backwards Compatibility | Yes - older nodes still see new blocks as valid | No - old nodes reject blocks created under new rules |

| Typical Use Cases | Minor parameter tweaks, new script opcodes | Major redesigns, new consensus mechanisms |

| Resulting Chains | Single chain (no split) | Two distinct chains and possibly two tokens |

| Community Impact | Usually low friction | Potentially high conflict, new communities |

| Activation Method | Often via miner/validator signalling | Scheduled block height or timestamp |

- Identify the problem. Developers draft a change, often as an improvement proposal.

- Community review. Core developers, miners/validators, and community members discuss the proposal.

- Testing. Testnets simulate the change; automated test suites ensure no unintended side-effects.

- Schedule activation. Once consensus is reached, the change is locked to a future block height or timestamp.

- Node upgrade. Nodes download the new client software and start enforcing the updated rules.

- Chain split (hard fork only). If some nodes continue running the old software, the network bifurcates.

Bitcoin Cash (2017)

Hard fork for larger block sizes. Created two distinct communities and tokens.

Ethereum Merge (2022)

Coordinated hard fork switching from proof-of-work to proof-of-stake.

TL;DR

- A blockchain fork splits a chain into two separate histories.

- Soft forks stay compatible; hard forks create a brand‑new coin.

- Forks start with a proposal, get scheduled at a block height, then nodes choose which chain to follow.

- Community, exchanges, wallets and developers must coordinate to avoid chaos.

- Future forks will rely more on on‑chain governance and less on abrupt splits.

What Is a Blockchain Fork?

In the world of decentralized ledgers, a blockchain fork is a divergence in the transaction history and protocol rules of a blockchain network. When the rules that govern how blocks are added change, the network can split into two parallel chains, each following a different set of rules. The original chain continues as before, while the new chain carries the same history up to the split point and then moves on with its own updates.

Two Main Flavors: Soft Fork vs. Hard Fork

Forks come in two technical categories. Both affect how nodes the computers that validate transactions and store the ledger interpret new blocks, but the compatibility implications differ dramatically.

| Aspect | Soft Fork | Hard Fork |

|---|---|---|

| Backwards Compatibility | Yes - older nodes still see new blocks as valid | No - old nodes reject blocks created under new rules |

| Typical Use Cases | Minor parameter tweaks, new script opcodes | Major redesigns, new consensus mechanisms |

| Resulting Chains | Single chain (no split) | Two distinct chains and possibly two tokens |

| Community Impact | Usually low friction | Potentially high conflict, new communities |

| Activation Method | Often via miner/validator signalling | Scheduled block height or timestamp |

The Technical Journey of a Fork

Every fork begins with a concrete need - a security bug, a scalability bottleneck, or an ideological split. The process typically follows these steps:

- Identify the problem. Developers draft a change, often as a improvement proposal a formal document that outlines the code change, rationale, and impact (e.g., BIP, EIP).

- Community review. Core developers, miners/validators, and community members discuss the proposal on public forums and GitHub.

- Testing. Testnets simulate the change; automated test suites ensure no unintended side‑effects.

- Schedule activation. Once consensus is reached, the change is locked to a future block height or timestamp.

- Node upgrade. Nodes download the new client software and start enforcing the updated rules at the scheduled point.

- Chain split (hard fork only). If some nodes continue running the old software, the network bifurcates, creating two independent ledgers.

During the split, each chain continues to accept transactions, but the economic value and community support decide which chain thrives.

Live Fork vs. Codebase Fork

A codebase fork copies the source code of an existing blockchain project and modifies it to launch a new network often happens before any blocks are mined. Bitcoin’s many altcoins are classic examples, where developers took the Bitcoin repository, changed parameters like block time, and launched a fresh chain.

By contrast, a live blockchain fork occurs when an already running network splits at a specific block. The Ethereum 2.0 transition (the "Merge") and Bitcoin Cash’s split from Bitcoin are live forks - the software was identical up to the split point, then diverged.

Community Ripples: From Tokens to Governance

When a hard fork produces a new chain, a fresh token the native cryptocurrency that powers the network often emerges. Holders of the original coin automatically receive the new token on the forked chain, which can trigger tax obligations and regulatory scrutiny.

Exchanges must decide whether to list the new token, wallet providers need to add support, and developers may need to maintain libraries for both chains. This coordination effort is why many projects now employ governance tokens digital assets that give holders voting rights on protocol upgrades. Token‑based voting can smooth the path to a fork by giving the community a clear signal of support.

Real‑World Cases: Lessons Learned

Bitcoin Cash (2017) - A hard fork driven by a desire for larger block sizes. The split created two distinct communities: Bitcoin (BTC) kept the 1MB limit, while Bitcoin Cash (BCH) moved to 8MB, later 32MB. Exchanges that hurried to list BCH faced liquidity issues, while miners split into two pools.

Ethereum’s Merge (2022) - A coordinated hard fork that switched consensus from proof‑of‑work to proof‑of‑stake. Massive testing phases, validator‑only testnets, and a clear activation block helped avoid a chain split. The community’s focus on a single, unified upgrade made the transition smoother than many earlier hard forks.

Smaller projects often see less drama because fewer stakeholders are involved, but they still need to communicate upgrade dates clearly to avoid node operators remaining on the old code.

Managing a Fork: A Practical Checklist

Whether you’re a developer, exchange, or token holder, the following steps help keep the process orderly:

- Read the proposal. Understand the technical changes and the rationale.

- Test locally. Run a full node on a testnet with the upgraded client.

- Communicate the date. Post the activation block height across all official channels.

- Coordinate with partners. Inform exchanges, wallet providers, and mining pools weeks in advance.

- Backup wallets. Export private keys or seed phrases before the fork to safeguard access.

- Monitor the network. After the fork, watch for chain reorgs, duplicate transactions, or unexpected price swings.

Where Forks Are Headed

Newer layer‑1 protocols are building formal on‑chain governance, letting token holders vote on upgrades without needing a disruptive hard fork. Proof‑of‑stake designs also make it easier to change parameters via validator consensus.

Interoperability solutions like bridges and cross‑chain messaging reduce the pressure to fork for feature upgrades - projects can link to specialized chains rather than rewrite the base layer.

Regulators are paying close attention. A fork that creates a new token may trigger tax events or classification as a security, influencing how exchanges list the asset. Projects now draft legal frameworks before a fork to stay compliant.

Frequently Asked Questions

What is the difference between a soft fork and a hard fork?

A soft fork is backward compatible - old nodes still see new blocks as valid, so the network stays as one chain. A hard fork is not compatible; nodes that don’t upgrade will reject the new blocks, resulting in two separate blockchains and often two different tokens.

Do I need to do anything when a fork occurs?

If you hold the native coin, you’ll automatically receive the new token on the forked chain, but you should back up your wallets and confirm that your exchange supports the new asset. Developers need to upgrade their node software to the new version.

Can a fork happen without creating a new cryptocurrency?

Yes. Soft forks often introduce new features (e.g., SegWit on Bitcoin) without spawning a separate coin. The blockchain stays unified, and users don’t receive any extra token.

How do developers decide the activation point for a fork?

They pick a future block height or timestamp that gives the community enough time to upgrade. The chosen point is usually encoded in the improvement proposal and communicated weeks in advance.

What role do governance tokens play in modern forks?

Governance tokens let holders vote on protocol changes, turning a potential hard fork into an on‑chain decision. If the vote passes, the network can upgrade smoothly; if it fails, the code remains unchanged, avoiding a split.

Stefano Benny

June 18, 2025 AT 12:07Well, the whole soft‑fork vs hard‑fork narrative is just another layer‑1 hype drumbeat. 🚀 In reality, the consensus‑engine upgrade vectors are more about validator lock‑in than any mystical split. The DAO‑style governance tokens only mask the underlying centralization pressure. If you ignore the economic incentives, you’ll miss why hard forks often spawn competing ecosystems. So before you get dazzled by the buzzwords, remember the game is all about block‑height signaling.

Bobby Ferew

June 23, 2025 AT 12:07Reading this feels like watching the same old saga replayed on loop. The author tries to sound helpful but ends up drowning us in buzz‑filled boilerplate. It’s almost comforting how predictably vague the “checklists” are. Sure, tick the boxes and hope the market doesn’t bite you.

Somesh Nikam

June 28, 2025 AT 12:07Great overview! The step‑by‑step breakdown really captures the typical fork lifecycle. I especially appreciate the emphasis on testnet validation before mainnet activation. For newcomers, remembering to back up seed phrases can prevent heart‑ache later. Keep the community engaged through transparent signaling – it builds trust. 😊

Jan B.

July 3, 2025 AT 12:07Nice summary. Clear and to the point.

MARLIN RIVERA

July 8, 2025 AT 12:07This is just a rehash of textbook material; nothing novel.

Debby Haime

July 13, 2025 AT 12:07If you’re gearing up for a fork, now’s the time to rally your nodes and your crew! Make sure every validator has the latest client version – there’s no room for lag. Communicate the activation block on all channels so nobody shows up late to the party. Remember, a smooth upgrade can boost community confidence and token price. Let’s turn this fork into a win for everyone!

emmanuel omari

July 18, 2025 AT 12:07From my perspective, the only forks worth noting are those that reinforce the sovereignty of our native blockchain ecosystem. Any external protocol trying to impose a hard fork is a thinly veiled attempt at economic colonization. Our developers should focus on on‑chain governance rather than borrowing ideas from foreign chains. The future belongs to home‑grown solutions.

Andy Cox

July 23, 2025 AT 12:07Looks solid enough the breakdown is easy to follow I guess. Hard forks always seem dramatic but soft forks just sneak in changes. Everyone just needs to keep an eye on the block height. Nothing too crazy

Courtney Winq-Microblading

July 28, 2025 AT 12:07When we stare into the abyss of a blockchain split, we glimpse not just code but the very pulse of collective belief. A hard fork can feel like a philosophical schism, a rite of passage for a community seeking a new identity. Yet the underlying ledger remains a ledger, indifferent to our narratives. The beauty lies in how we assign meaning to each branch, weaving stories of resilience, ambition, and sometimes folly. As developers, we are both poets and engineers, scripting futures with each forked fork. The choice between compatibility and innovation mirrors humanity’s own dance between tradition and rebellion. In the end, the chain that survives is the one nourished by shared purpose, not merely technical superiority. So let the debates roar, but remember the true value rests in the trust we place behind every hash.

katie littlewood

August 2, 2025 AT 12:07Understanding blockchain forks is akin to studying the branching of a great river of ideas, each tributary reflecting a distinct philosophical stance on decentralization, governance, and economic incentives. First, one must appreciate that a soft fork is not merely a technical tweak but a subtle negotiation between legacy nodes and progressive developers, allowing the ecosystem to evolve without fracturing its communal identity. By contrast, a hard fork resembles a decisive revolution, where the old guard is compelled to either adapt to a new regime or be left behind, often spawning an entirely new token and a fresh community narrative. The process usually begins with a well‑crafted improvement proposal, such as a BIP or EIP, which lays out the rationale, code changes, and anticipated impact in meticulous detail. Following the proposal, a period of open discussion ensues on public forums, GitHub issues, and social media, where stakeholders from miners to wallet providers articulate concerns, suggest refinements, and gauge the community’s pulse. Next comes rigorous testing on testnets, where developers simulate the proposed changes under real‑world conditions, hunting for edge‑case bugs that could jeopardize network security. Once confidence is established, a specific block height or timestamp is scheduled for activation, providing a clear horizon for node operators to upgrade their software. On the day of activation, nodes running the updated client begin enforcing the new consensus rules, while any node still on the legacy version will either reject new blocks or diverge, creating a fork. If the fork is hard, the divergence results in two separate chains, each with its own tokenomics, governance structures, and market dynamics. This bifurcation can be both an opportunity and a challenge: it offers innovation pathways for one chain while fragmenting liquidity and user attention across both. Exchanges, custodians, and liquidity providers must act swiftly to list the new asset, ensuring that traders can move between chains without undue friction. Meanwhile, developers often need to maintain two codebases, documenting differences and providing support for users on either side of the split. Over time, one chain typically dominates due to stronger network effects, superior developer activity, or clearer value proposition, while the other may wane or carve out a niche. Importantly, modern protocols are increasingly embedding on‑chain governance mechanisms, allowing token holders to vote on upgrades, thereby reducing the need for disruptive hard forks altogether. As the blockchain ecosystem matures, we can expect fewer dramatic splits and more elegant, collaborative evolutions driven by consensus rather than conflict. In summary, forks are not merely technical events but social experiments that test the resilience, adaptability, and collective vision of decentralized communities.

Jenae Lawler

August 7, 2025 AT 12:07While the preceding exposition paints a rosy panorama of on‑chain governance, one must not overlook the inherent centralizing drift that such voting mechanisms can introduce. By aggregating decision‑making power into a token‑weighted majority, the system subtly privileges affluent stakeholders, potentially marginalizing the very decentralization ethos it purports to uphold. Moreover, the assumption that fewer hard forks equates to progress neglects the historical moments where contentious hard forks, such as Ethereum Classic’s emergence, have reinforced ideological clarity. Hence, the narrative that governance tokens are an unequivocal panacea is, at best, overly optimistic.

Chad Fraser

August 12, 2025 AT 12:07Absolutely, the community hype is half the battle! Getting everyone on the same upgrade schedule eliminates the dreaded “split‑or‑stay” dilemma. Let’s keep the momentum high and celebrate each milestone together. 🎉

Jayne McCann

August 17, 2025 AT 12:07Actually, the checklist is just common sense.

Richard Herman

August 22, 2025 AT 12:07Your emphasis on backups and transparent signaling truly resonates – it’s the glue that holds any fork together.

Parker Dixon

August 27, 2025 AT 12:07Great point about validator lock‑in. For anyone planning a fork, remember to monitor the signaling bits on block explorers, as they reveal the real readiness of the network. 🤓