Crypto Exchange: Your Guide to Choosing, Using, and Staying Safe

When working with crypto exchange, a platform that lets you buy, sell, or trade digital assets like Bitcoin, Ethereum, and thousands of altcoins, digital asset exchange, you step into a market that serves beginners and pros alike. In this fast‑moving space, the crypto exchange landscape changes daily, so having the right context matters.

Key Factors to Understand

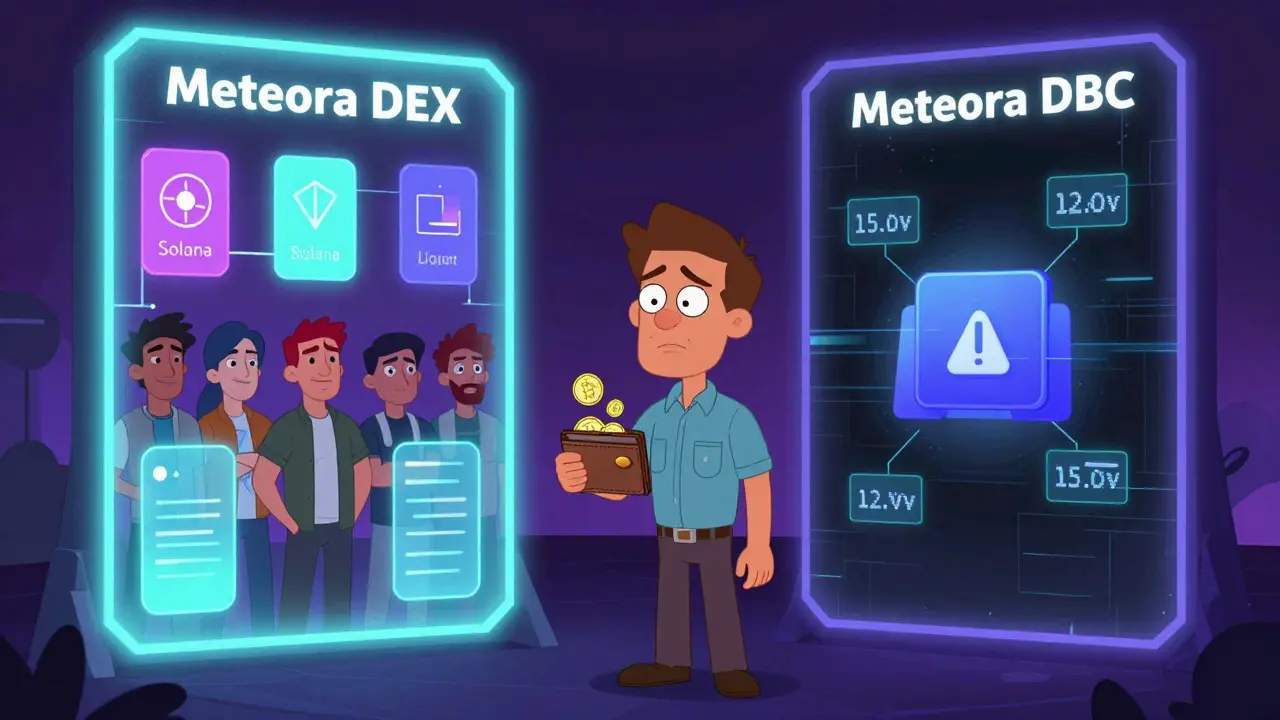

One important subtype is the decentralized exchange, a peer‑to‑peer platform that lets you trade without surrendering custody of your coins. Because it runs on smart contracts, it often promises greater privacy and reduced counterparty risk, which is why many traders say a decentralized exchange encompasses non‑custodial trading.

Another crucial factor is exchange fees, the costs you pay per trade, withdrawal, or deposit. Fees can range from near‑zero on some DEXs to several percent on premium services. These costs directly influence trading liquidity, because higher fees deter large orders and can increase slippage.

Security, or exchange security, measures like cold storage, two‑factor authentication, and regular audits, determines how safe your funds are against hacks. Strong security protects user assets and builds trust, which is why many platforms highlight their security track record in marketing.

Regulators now demand KYC and AML compliance, processes that verify user identities and monitor transactions for illegal activity. This requirement requires identity verification during onboarding, and it shapes the way exchanges design their user experience. At the same time, liquidity depth, the amount of buy and sell orders available at each price level is a key metric that improves trade execution speed and reduces slippage, especially in volatile markets.

When you compare platforms, look at the balance between fees, security, regulatory compliance, and liquidity. Spot trading, derivatives, and staking options add layers of functionality, but the core decision still hinges on how well an exchange protects your money, how transparent its fee structure is, and whether it meets the legal standards of your jurisdiction. Below you’ll find in‑depth reviews of popular exchanges, breakdowns of fee models, security audits, and compliance guides that will help you pick the right platform for your trading style.