There’s a crypto exchange called Meteora DBC that’s showing up on trading dashboards and Discord channels, but nobody seems to agree on what it actually is. You search for it, find a trading volume of $11 million in 24 hours, see 140,000 weekly visits, and think, "This might be the next big thing." Then you dig deeper-and you hit a wall. No official website. No team bio. No whitepaper. No clear list of supported coins. Just a Discord link and a handful of forum mentions. That’s not how legit exchanges operate. And if you’re thinking about putting money here, you need to know why.

What Is Meteora DBC, Really?

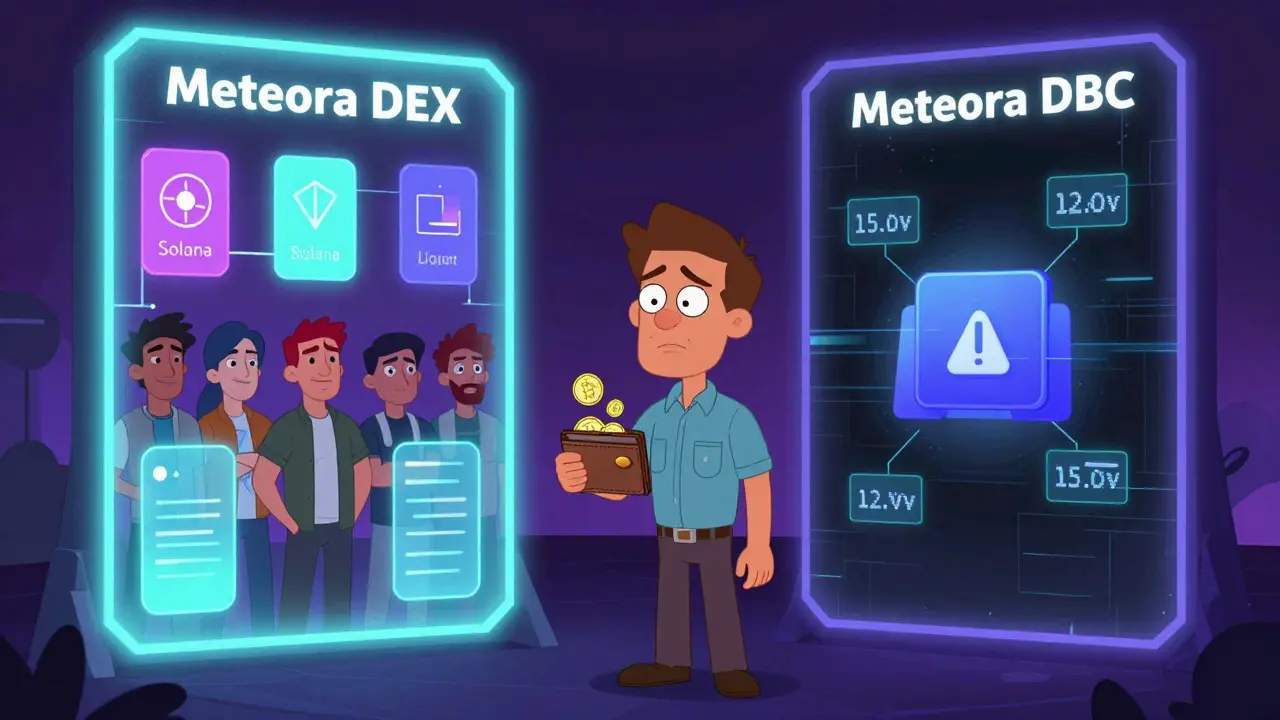

Meteora DBC isn’t Meteora DEX. That’s the first thing you have to untangle. Meteora DEX is a well-documented, high-performance decentralized exchange built on Solana. It’s got $800 million locked in liquidity, daily swap volumes over $200 million, and a team of experienced DeFi devs. It uses advanced features like Dynamic Liquidity Market Makers (DLMM), yield-optimizing vaults, and low-slippage trading pools. It’s trusted by serious traders and has been covered by major crypto outlets like Coin Bureau. Meteora DBC? None of that applies. There’s zero public documentation linking it to the same team, technology, or infrastructure. It doesn’t use Solana’s DeFi stack. It doesn’t integrate with Jupiter. It doesn’t have DLMM pools or Dynamic Vaults. It’s not even listed on CoinGecko or CoinMarketCap as a verified exchange. The only real data points are a trading volume figure and a Discord server. That’s not enough to call it a platform-it’s barely enough to call it a presence.Why the Confusion?

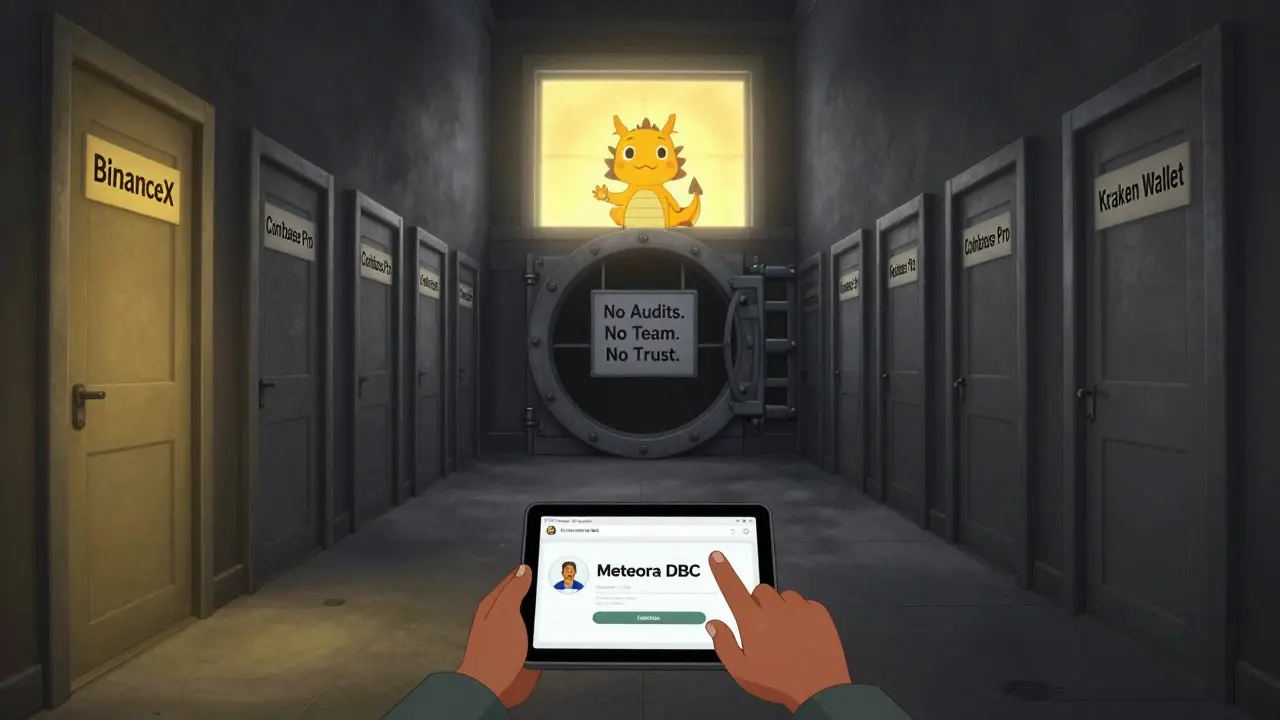

The name is the problem. "Meteora" is a recognizable brand in Solana DeFi. When someone types "Meteora DBC," search engines and bots often mix it up with Meteora DEX. Some sites even auto-fill the wrong URL. You might end up on a page that looks like a crypto exchange but is actually a scam mirror site or a low-volume aggregator with no custody controls. There are dozens of these copycat names in crypto-"BinanceX," "Coinbase Pro," "Kraken Wallet"-all designed to trick users into depositing funds on platforms that vanish overnight. If you’re seeing Meteora DBC on a trading app or a price tracker, check the domain. Is it meteora-dbc.com? meteora-dbc.io? meteora-dbc.exchange? None of these are official. The real Meteora DEX operates at meteora.ag. If you’re not on that domain, you’re not on the real thing.Trading Volume and Traffic: What They Don’t Tell You

$11 million in 24-hour volume sounds impressive until you compare it to real exchanges. Binance does over $10 billion daily. Even smaller centralized exchanges like KuCoin or Bybit hit $1-2 billion. On the decentralized side, Raydium and Orca on Solana do $50-100 million daily. Meteora DBC’s volume is less than 5% of what Meteora DEX moves in a single day. That’s not a growth signal-it’s a red flag. The 141,706 weekly visits? That’s roughly 20,000 daily. For a platform with no marketing budget, no app, and no media coverage, that’s suspiciously high. It suggests bot traffic, pump-and-dump groups, or paid clicks from affiliate networks. Real users don’t find platforms like this by accident. They find them through trusted reviews, YouTube tutorials, or wallet integrations. None of those exist for Meteora DBC.

No KYC, No Security, No Accountability

You can’t review a crypto exchange without knowing its security practices. Does it use cold storage? Multi-sig wallets? Has it been audited? Is there a bug bounty program? Does it require KYC? For Meteora DBC, the answer to all of these is: unknown. No audits have been published. No security team has been named. No insurance fund exists. No public record of past hacks or incidents. That’s dangerous. In 2025, even small exchanges are expected to show at least basic transparency. If you’re depositing crypto here, you’re trusting a black box. If the platform disappears tomorrow, your funds vanish with it. And you won’t have any legal recourse. No country regulates Meteora DBC. No financial authority oversees it. It’s not registered with FinCEN, the FCA, or any other body.The Discord Trap

The only community link you’ll find is a Discord server: discord.gg/WwFwsV. That’s not a customer support channel-it’s a hype machine. Look at the members: mostly new accounts with generic usernames. Lots of "BUY NOW" and "TO THE MOON" posts. No experienced traders. No technical discussions. No answers to questions like "Where are my funds stored?" or "Who runs this?" Real exchanges have dedicated support teams, help centers, and documented procedures. They respond to complaints publicly. Meteora DBC’s Discord? Silence. If you ask a question about withdrawals, you’ll get a DM from someone offering to "help you recover funds"-that’s a classic phishing setup.

Who Is This For?

Meteora DBC isn’t for serious traders. It’s not for long-term holders. It’s not even for beginners who want to learn. It’s for people who don’t know any better. People who see a name that sounds familiar, click a link from a Telegram group, and deposit their ETH or SOL without checking anything else. If you’re thinking of using it because you saw a "10x return" post on X or Reddit, walk away. Those posts are paid ads. The people posting them aren’t users-they’re shills. They get paid per deposit. The platform doesn’t need to be good. It just needs to collect funds before it shuts down.What Should You Do Instead?

If you want to trade on Solana, use a real DEX. Raydium, Orca, and Jupiter are all audited, transparent, and widely used. They have apps, support teams, and public roadmaps. You can see their liquidity pools. You can track their fees. You can read their audit reports. If you want a centralized exchange, stick with Kraken, Binance, or Coinbase. They’re regulated, insured, and have years of track records. Yes, they require KYC. That’s not a flaw-it’s protection. And if you’re still tempted by Meteora DBC? Ask yourself this: Would you hand over your bank account password to a stranger who sent you a link? Crypto is the same. If you don’t know who’s behind it, don’t touch it.Final Verdict: Avoid Meteora DBC

There’s no evidence that Meteora DBC is a legitimate, secure, or sustainable crypto exchange. The name is confusingly similar to a real, respected platform. The data is thin and unverifiable. The security posture is nonexistent. The community is a ghost town with bots. The only thing it has going for it is a number on a chart-and that number could be fabricated. This isn’t a risky investment. This is a trap. Save yourself the stress, the losses, and the sleepless nights. Walk away. Find a real exchange. The crypto world is full of them. You don’t need to gamble on shadows.Is Meteora DBC the same as Meteora DEX?

No, they are completely different. Meteora DEX is a well-known, audited, Solana-based decentralized exchange with $800 million in TVL and daily volumes over $200 million. Meteora DBC has no technical documentation, no public team, no audits, and no connection to the Meteora DEX team. The similarity in names is misleading and likely intentional.

Can I trust Meteora DBC with my crypto?

No. There is no public information about its security practices, wallet storage, or insurance. No audits have been published. No regulatory body oversees it. If you deposit funds, you are risking them on a platform with zero accountability. History shows platforms like this often disappear after collecting deposits.

Why does Meteora DBC show up on trading apps?

Many crypto aggregators and price trackers pull data from low-quality or unverified sources. Meteora DBC may appear because a bot scraped a Discord post or a fake website and added it to a database. This doesn’t mean it’s legitimate-it just means the data source is unreliable. Always verify the platform’s official website before trading.

What should I look for in a safe crypto exchange?

Look for: a clear company name and team, published audits, KYC/AML compliance, cold storage for funds, a public support channel (not just Discord), a website with contact info, and listings on trusted platforms like CoinGecko or CoinMarketCap. If any of these are missing, walk away.

Is there any chance Meteora DBC will become legitimate later?

Possibly-but not based on current evidence. Legitimate platforms don’t launch with no documentation, no team, and no transparency. If Meteora DBC ever becomes real, it will need to publish a whitepaper, hire a public team, get audited, and build a real website. Until then, treat it as a potential scam.

Paul Johnson

January 12, 2026 AT 23:50Bro just dont use it if its sketchy why are you even writing this like its a news article its obvious

Meenakshi Singh

January 14, 2026 AT 15:27OMG YES THIS IS SO TRUE 😭 I saw someone lose 5 SOL to this exact thing last week and they were crying in the Discord 😅 never trust a platform with no website

Michael Richardson

January 15, 2026 AT 18:09Typical crypto drama. Next you'll tell me Bitcoin is a scam because you don't know who Satoshi is.

Kelley Ramsey

January 17, 2026 AT 14:09I really appreciate how thorough this breakdown is - it’s so easy to get fooled by names that sound legit, especially when you’re new. Thank you for taking the time to clarify the difference between Meteora DEX and this fake one. So many people are going to avoid disaster because of this.

Sabbra Ziro

January 18, 2026 AT 11:51It’s heartbreaking how many people get hurt by these copycat platforms. I’ve seen beginners lose life savings because they trusted a Discord link. Let’s keep sharing posts like this - they save real people.

Krista Hoefle

January 19, 2026 AT 23:24Wow such a long post for something that’s obviously a rug pull. Did you get paid to write this?

Danyelle Ostrye

January 21, 2026 AT 04:25I don’t know why people keep falling for this. I’ve seen 10 of these in the last year. Same script. Same Discord. Same 10x claims. It’s like watching a horror movie you know ends badly but people still walk in.

sathish kumar

January 22, 2026 AT 13:44Respected sir, the phenomenon of name-squatting in the cryptocurrency domain is an egregious violation of ethical branding norms, and the absence of regulatory oversight renders such entities perilous to the unwary investor. One must exercise due diligence commensurate with the magnitude of financial exposure.

Don Grissett

January 22, 2026 AT 14:05you think this is bad wait till you see the new meteora dbc v2 its on telegram and the devs are from russia and they use ai to generate fake volume

Katrina Recto

January 24, 2026 AT 13:54I’ve been burned before by fake exchanges. This post saved me from making the same mistake. No emojis, no hype - just facts. That’s rare and valuable.

Veronica Mead

January 24, 2026 AT 20:50It is morally indefensible to operate a financial platform without transparency. To do so is to exploit human trust, and those who promote such platforms are complicit in financial predation.

Mollie Williams

January 26, 2026 AT 08:21There’s something deeply human about our willingness to believe in something that sounds like it could be real - even when every signal screams otherwise. We don’t want to be the one who missed the next big thing. So we ignore the red flags. We rationalize the silence. We tell ourselves, "Maybe this time it’s different." But it never is. The architecture of trust is built on transparency. When it’s absent, the entire structure collapses - and we’re the ones buried under the rubble.

Surendra Chopde

January 27, 2026 AT 14:03Good post. I checked Meteora DBC on CoinGecko - not listed. Checked Solana DeFi forums - no mention. Even my uncle in Mumbai, who only uses Phantom wallet, said "don’t touch it". Real traders know.

Tiffani Frey

January 29, 2026 AT 01:01Thank you for highlighting the difference between Meteora DEX and this impostor. I’ve had users ask me about this exact platform - now I have a clear, authoritative reference to share. The lack of a website alone should be a dealbreaker for any serious user.

Tre Smith

January 29, 2026 AT 03:20140k weekly visits? That’s bot traffic. I’ve seen this before - paid influencers push fake volume on Telegram, bots refresh the page, and aggregators eat it up. This isn’t a platform. It’s a data point in a scam dashboard.

Ritu Singh

January 29, 2026 AT 15:22They’re using this to feed data to the shadow government. You think they care about your crypto? They’re harvesting your wallet addresses for the next phase. The real Meteora is a front. This is just Phase 2.

kris serafin

January 31, 2026 AT 01:04Just FYI - I checked the Discord link. 98% of members are new accounts with no profile pics. One guy DM’d me saying "I can help you withdraw" - classic. Don’t even open it 🚫

Jordan Leon

February 1, 2026 AT 17:06There’s a quiet kind of wisdom in walking away. Not because you’re afraid, but because you’ve seen the pattern before. The market rewards patience, not panic. And the most dangerous thing isn’t missing a 10x - it’s losing everything chasing a ghost.

Sarbjit Nahl

February 3, 2026 AT 09:02The real issue isn't Meteora DBC. It's the collective delusion that any anonymous entity with a Discord link and a volume number deserves attention. We fetishize liquidity over legitimacy. We mistake noise for signal. We confuse popularity with trust. This isn't a warning about a scam exchange. It's a mirror held up to the entire crypto culture. We don't need more red flags. We need to stop being the ones who light them.