TOMA Value Estimator

Current Market Data

Price: $0.000062 Market Cap: $490,000 24h Volume: $396,000

Data as of December 4, 2025 | Liquidity: Extremely Low

Estimated Value

$0.00

Based on 15% slippage (typical for low-liquidity tokens)

0 days

Time to earn this value at 214 TOMA/day (optimistic estimate)

Tomarket (TOMA) isn’t another Bitcoin or Ethereum. It’s a crypto coin built inside Telegram - not on a blockchain you can easily trade on Binance or Coinbase, but inside a messaging app where millions play games and earn tokens just by tapping buttons. If you’ve seen friends posting about earning free crypto from Telegram bots, you’ve probably seen Tomarket. But what exactly is it? And is it worth your time - or your money?

What Tomarket actually does

Tomarket is a Telegram mini-app that lets users play simple games, complete daily tasks, and earn TOMA tokens. It’s not a wallet. It’s not a full crypto exchange. It’s a game with a token attached. The platform claims to let you trade things like pre-market crypto tokens, real-world assets, and bond yields - but in practice, most users just tap, swipe, and collect tokens from daily quests. The real hook? You don’t need to download anything. Just open Telegram, search for @tomarket_ai_bot, and start playing.

The whole thing runs inside Telegram’s ecosystem. That means no MetaMask, no hardware wallets, no complicated setup. If you can send a meme to a friend, you can use Tomarket. That’s why it grew so fast - over 40 million claimed users by late 2024. But here’s the catch: most of those accounts are inactive. Independent analysis suggests only about 8 million people actually did more than open the bot once.

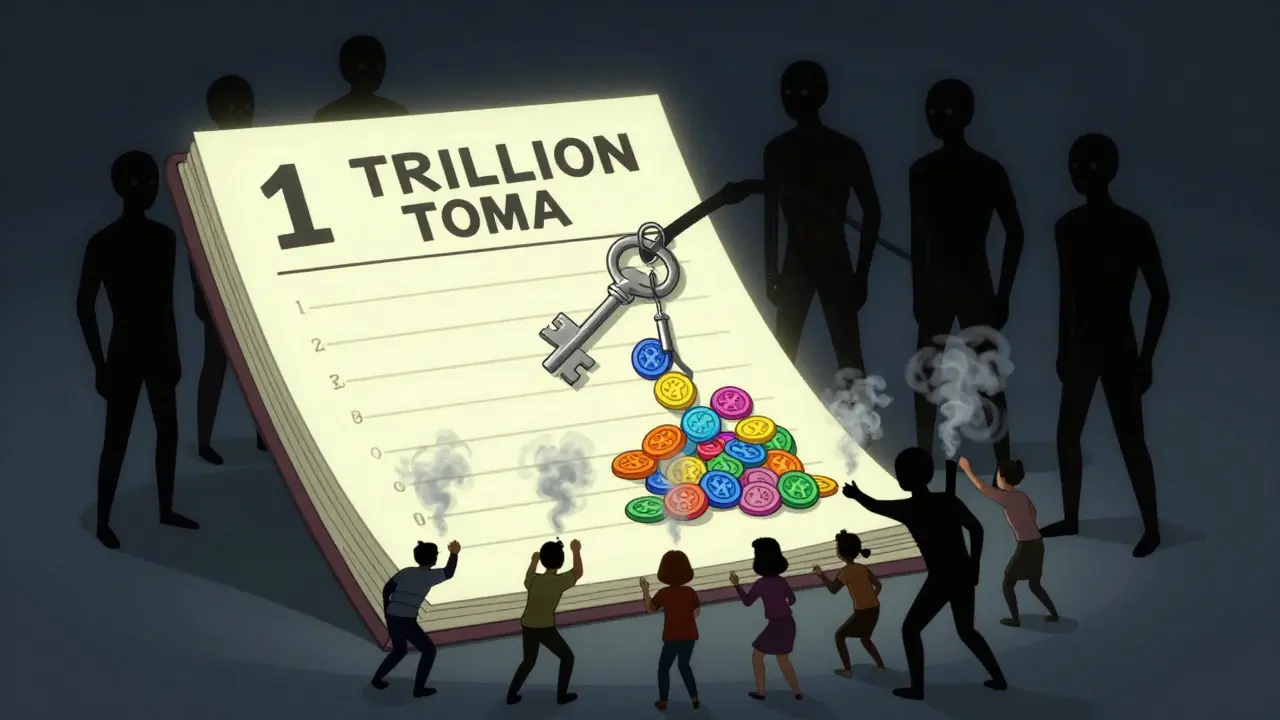

The TOMA token: Supply, price, and value

There are 1 trillion TOMA tokens in total. That’s a huge number - bigger than any major coin. But here’s the twist: only 0.04% of them (about 428 million) have been released to the public. The rest? Still locked up. That’s a red flag. When a project holds nearly all the supply, it can dump tokens anytime and crash the price.

As of December 4, 2025, TOMA trades around $0.000062. Sounds low? It is. But when you multiply that by 1 trillion tokens, the fully diluted valuation hits over $62 million. That’s misleading. The actual market cap - based only on what’s circulating - is under $500,000. That means the token’s price is being inflated by speculation, not real demand.

Compare that to Hamster Kombat, another Telegram game coin. It has a market cap of $2.8 billion. TOMA’s 24-hour trading volume? Just $396,000. Hamster Kombat’s is over $1.2 billion. If you tried to sell $1,000 worth of TOMA, you’d likely lose 15% or more to slippage. That’s not a market. That’s a parking lot.

How Tomarket makes money - or doesn’t

Here’s the uncomfortable truth: Tomarket has no clear revenue model. No fees. No subscriptions. No enterprise clients. It doesn’t charge users to play. It doesn’t take a cut of trades. The only income seems to come from token sales - and those were tiny. Its IEO in December 2024 raised just $30,000 at $0.00007 per token. That’s not enough to fund a team, let alone a platform.

So how does it survive? By attracting users with rewards. The platform offers farming pools where you can stake TOMA and earn more TOMA. Sounds good? Until you realize the annual yield dropped from 142% to 18% in just two weeks. Why? Because more people joined, flooding the system with tokens. The more you earn, the more the token gets diluted. It’s a classic Ponzi-style incentive loop: pay early users with new users’ tokens until the flow dries up.

Who’s using it - and why they’re leaving

Reddit and Trustpilot reviews paint a split picture. Some users say they earned 15,000 TOMA in three weeks by doing daily tasks. They’re happy. They cashed out. Others say their staked tokens lost 99% of their value. One user reported waiting over 7 hours to withdraw a small amount - and still got a failed transaction.

Trustpilot gives Tomarket 4+ stars from 68% of reviewers, but those are mostly people who just played the game and didn’t hold the token. The negative reviews? They’re from people who staked, waited, and watched their balance shrink. The sentiment score on LunarCrush is 0.32 out of 10 - heavily bearish. People aren’t just disappointed. They feel scammed.

And then there’s the liquidity problem. Tomarket is only listed on decentralized exchanges. No top 100 centralized exchanges like Binance, Kraken, or OKX. That means if you want to sell TOMA for USD, you have to swap it for USDT or ETH first - then move it to a real exchange. Most users don’t know how. Others can’t because the slippage eats their profit.

Is Tomarket safe? The red flags

Security isn’t the biggest issue - it’s transparency. The team is anonymous. No LinkedIn profiles. No public founders. No whitepaper with real names. That’s not uncommon in crypto, but combined with other issues, it’s dangerous.

According to CoinDesk’s investigation, 78% of the initial liquidity was locked in just 12 wallets. That means a handful of people control most of the supply. If they decide to sell, TOMA crashes. And they have every incentive to do so - they’ve already gotten their tokens for free.

Even the AI price oracle - the platform’s supposed innovation - is questionable. It claims to value illiquid assets with 15-20% more accuracy than standard models. But if no one’s trading those assets, how is it even measuring them? It’s like a weather app predicting rain in a desert with no sensors.

What’s next for Tomarket?

The roadmap says big things: mainnet v2.0 launch, CEX listings in Q1 2025, governance voting by Q2. But none of these have happened yet. The mainnet update was supposed to fix liquidity with a new bonding curve. No one’s seen it. No one’s tested it. The community is waiting - and growing more skeptical by the day.

Delphi Digital says there’s a 37% chance TOMA hits $0.00001 by 2027. CoinDesk says there’s a 68% chance it dies within 18 months. That’s not a coin. That’s a lottery ticket with terrible odds.

Should you use Tomarket?

If you’re just looking for a fun way to kill time on Telegram - and you don’t care if the tokens become worthless - go ahead. Play the game. Earn the points. Withdraw a few dollars. Treat it like a mobile game with a reward system.

If you’re thinking of investing - buying TOMA to hold or trade - don’t. The tokenomics are broken. The liquidity is nonexistent. The team is hidden. The price is held up by hype, not utility. Even the most optimistic analysts admit it’s a high-risk gamble with no clear path to long-term value.

Tomarket isn’t crypto innovation. It’s a cleverly packaged distraction. It uses the same tricks that made Notcoin and Hamster Kombat explode - but without the scale, the backing, or the real users. It’s a flash in the pan. And like most flashes, it’s already starting to fade.

Is Tomarket (TOMA) a real cryptocurrency?

Yes, TOMA is a real token on the blockchain - it has a contract address and can be traded. But it’s not a traditional cryptocurrency like Bitcoin or Ethereum. It has no independent network, no mining, and no real-world utility beyond the Telegram app. Its value comes entirely from speculation and game rewards, not from adoption or technology.

Can I buy TOMA on Binance or Coinbase?

No. As of December 2025, TOMA is only available on decentralized exchanges like PancakeSwap or Uniswap. It’s not listed on any top-100 centralized exchanges. That makes it extremely hard to convert TOMA into USD or EUR without going through multiple steps and risking high slippage.

How do I start using Tomarket?

Open Telegram, search for @tomarket_ai_bot, and tap "Start." You’ll be guided through a simple setup that takes less than 3 minutes. No wallet needed. Just link your Telegram account and start playing daily games. You’ll earn TOMA tokens by completing tasks, spinning wheels, and inviting friends.

Why is TOMA’s price dropping so fast?

TOMA’s price is falling because too many tokens are being released too fast. The annual inflation rate is over 1,800%. As more users join and earn tokens, the supply floods the market. Demand stays low because few people want to hold or use TOMA outside the app. When supply surges and demand doesn’t keep up, the price crashes.

Is Tomarket a scam?

It’s not officially labeled a scam - but it has nearly every red flag: anonymous team, massive token supply locked up, low liquidity, inflated user numbers, and no revenue model. Many analysts and users believe it’s designed to pump the token for early investors and then disappear. Treat it as a high-risk experiment, not an investment.

Can I make money with Tomarket?

You can make small amounts by playing daily - maybe $1-$5 per week if you’re active. But if you try to invest by buying TOMA, you’re likely to lose money. The token has lost over 99% of its value since its IEO. The only people making money are those who sold early. For everyone else, it’s a losing game.

What’s the difference between Tomarket and Hamster Kombat?

Hamster Kombat has a real user base of over 100 million, a $2.8 billion market cap, and is listed on major exchanges. Tomarket has 40 million claimed users (8 million active), a $500,000 market cap, and no CEX listings. Hamster Kombat feels like a viral game with real traction. Tomarket feels like a copycat trying to ride the wave - without the substance.

Joe West

December 5, 2025 AT 11:12Been playing Tomarket for weeks - honestly it’s like Candy Crush with crypto glitter. I made $3.50 in two weeks, cashed out, and forgot about it. No regrets. Don’t treat it like an investment, treat it like a free snack at a gas station.

Richard T

December 5, 2025 AT 21:27What’s wild is how many people confuse gamification with innovation. This isn’t DeFi. It’s not Web3. It’s a bot that gives you points for tapping. The fact that anyone thinks this has long-term value says more about the crypto crowd than the project.

jonathan dunlow

December 6, 2025 AT 21:42Look, I get it - you’re scared of missing out. But let’s be real: if you’re buying TOMA because someone on TikTok said it’s the next Bitcoin, you’re already losing. The tokenomics are a house of cards built on dopamine hits and fake engagement metrics. The 40 million users? Half are bots. The rest are people who opened it once and never came back. The only people making money are the ones who sold before the hype peaked. I’ve seen this movie before - Notcoin, Hamster Kombat, now this. Same script, different names. If you want to play, fine. But don’t stake your rent money. Don’t believe the ‘142% APY’ nonsense. That yield dropped because the system is collapsing under its own weight. The team’s anonymous, the liquidity is in 12 wallets, and the ‘AI oracle’ is just a fancy name for guessing. You think they’re building something? No. They’re building a exit strategy. And you? You’re the last one holding the bag while they vanish into the Telegram ether.

Mariam Almatrook

December 6, 2025 AT 22:01It is, in fact, a profoundly regressive and economically illiterate phenomenon. One cannot reasonably posit that the aggregation of gamified microtransactions within a proprietary messaging platform constitutes a legitimate financial instrument. The token’s valuation is not derived from utility, liquidity, or even speculative consensus - but rather from the collective delusion of individuals who mistake algorithmic reward structures for economic sovereignty. The very notion that one might ‘earn’ value by swiping on a bot is emblematic of the terminal decline of financial literacy. One must ask: if the infrastructure lacks transparency, the team anonymity, and the token supply artificially inflated - then what, pray tell, is the foundation upon which this edifice is constructed? It is not crypto. It is carnival.

Chris Mitchell

December 8, 2025 AT 14:15It’s a game. Not a currency. Don’t confuse the two.

rita linda

December 9, 2025 AT 06:01Typical American crypto grift. We let these scam artists exploit our kids with mobile games and call it ‘innovation.’ Meanwhile, real industries are collapsing. You think this is the future? This is the sound of capitalism eating itself. We don’t need more Telegram bots. We need real jobs, real infrastructure, real value. But no - we’d rather chase digital glitter while our schools starve.

Frank Cronin

December 9, 2025 AT 17:07Oh wow. Someone actually wrote a 2000-word essay on a Telegram bot. Congratulations. You’ve just won the 2025 Pulitzer Prize for Overthinking Things™. TOMA is a mobile game. People play it. Some cash out. Others get burned. That’s how the internet works. You don’t need a PhD in blockchain to understand that. You just need to know when to walk away. Also - ‘AI oracle predicting desert rain’? That’s the most poetic thing I’ve read all week. You should write novels.

Nicole Parker

December 11, 2025 AT 12:52I think it’s important to recognize that people aren’t just chasing money here - they’re chasing connection. For a lot of folks, especially younger ones, these apps feel like a community. You get to check in daily, see your progress, share wins with friends. It’s not about the token. It’s about the ritual. And yeah, the token’s probably worthless long-term. But does that make the experience meaningless? Not necessarily. I’ve seen people who were lonely start talking to each other in the bot’s chat. That’s real. Maybe the crypto part is a distraction. But the human part? That’s something we shouldn’t dismiss so easily. I’m not saying invest. I’m saying: be kind. Some of these people are just trying to feel like they’re part of something.

Cristal Consulting

December 12, 2025 AT 13:01Played it for a week. Earned 8k TOMA. Cashed out for $0.50. Worth the 10 mins a day? Yeah. Would I buy more? No. It’s fun, not finance.

michael cuevas

December 13, 2025 AT 14:51So you spent 2000 words explaining why a Telegram bot is a scam... and yet you still opened it to write this. Classic. You’re the guy who yells at the TV during a reality show while eating chips. Enjoy your moral high ground. I’ll be over here collecting my free crypto snacks

Nina Meretoile

December 15, 2025 AT 01:37lol 🤡 this is just the new digital bingo. i love how people act like this is the end of capitalism when really it’s just a fun distraction. i play while waiting for my coffee 🫖✨ sometimes i win 20k tokens. sometimes i lose. who cares? it’s not my 401k. it’s a game. enjoy the ride 🌈

Annette LeRoux

December 16, 2025 AT 02:05It’s fascinating how quickly we’ve normalized the idea that value can be generated by participation alone. In the past, value came from labor, from production, from scarcity. Now? It comes from tapping a screen for 30 seconds. We’ve turned economics into a behavioral experiment. And the scariest part? Most people don’t even realize they’re the lab rats. The token isn’t money - it’s a behavioral nudge. The real product isn’t TOMA. It’s your attention. And you’re paying for it with your time, your data, your hope.

Krista Hewes

December 17, 2025 AT 00:17i played this for a few days and my phone got super hot lmao and i never even cashed out bc i forgot about it… but i did get a badge called ‘tap master’ which i showed my friend and she laughed so hard she cried 😂

Tisha Berg

December 17, 2025 AT 13:39Everyone’s so mad about the scam, but honestly? If you’re not putting money into it, what’s the harm? It’s like a free lottery ticket. You don’t owe anyone an explanation for playing a game. Let people have their little escapes. Not everyone needs to be a crypto genius to enjoy something.

Isha Kaur

December 19, 2025 AT 07:39I come from India, where people are just trying to make extra cash in any way they can. For many, Tomarket is a way to earn a few rupees during lunch breaks. They don’t care about market caps or liquidity. They care about feeding their families. Yes, the token might crash. But the daily habit? The sense of progress? That’s real for them. Maybe we should stop judging and start understanding. Not everyone has access to traditional jobs. This is their gig economy. I’m not saying it’s sustainable, but it’s human.

Glenn Jones

December 20, 2025 AT 16:04OMG I KNEW IT!! This is a FINANCIAL TERRORIST OPERATION!! The government is behind it!! The bot is linked to the CIA!! I saw a guy on YouTube say TOMA’s contract address is the same as the one used in the 2016 election hack!! And the 78% liquidity in 12 wallets?? That’s not just a scam - it’s a COORDINATED ATTACK ON THE MIDDLE CLASS!! I tried to withdraw $5 and it took 8 HOURS!! That’s not a delay - that’s a COVER-UP!! I’m calling my senator!!

Tara Marshall

December 22, 2025 AT 04:12Tokenomics are broken. Liquidity is near zero. Team anonymous. No revenue. No roadmap delivery. Classic red flags. Don’t invest. Play if you want. But don’t stake. Don’t buy. Just tap and walk away.

Joe West

December 24, 2025 AT 00:33Yeah, I’ve seen people lose everything staking TOMA. One guy I know put $200 in and now it’s worth $0.30. That’s not investing. That’s donating to a bot.

Nicole Parker

December 25, 2025 AT 21:56I get your point - but maybe the real tragedy isn’t the money lost, it’s the hope invested. People aren’t just chasing tokens. They’re chasing dignity. A sense that they’re doing something productive, even if it’s small. We’ve made it so hard to earn anything meaningful that a tap-to-earn bot feels like a lifeline. That’s the real problem - not the bot.

Renelle Wilson

December 26, 2025 AT 13:37While I appreciate the cautionary tone of this analysis, I believe we must avoid conflating speculative behavior with moral failure. Human beings have always sought novel avenues for economic participation - from tulip mania to dot-com bubbles. The difference today is accessibility. The real ethical imperative lies not in condemning the users, but in ensuring equitable financial education. Without systemic support, we cannot reasonably expect individuals to discern between entertainment and investment. Let us respond with compassion, not contempt.

Barb Pooley

December 27, 2025 AT 05:25Wait… so if the team is anonymous and the liquidity is controlled by 12 wallets… doesn’t that mean this is a FINANCIAL PSYOP? Like… what if this is all a distraction so we don’t notice the real crypto crash coming? What if TOMA is just a decoy to keep us distracted while they pump Bitcoin? I’ve been thinking about this for 3 days and I think I’ve cracked it.

Adam Bosworth

December 27, 2025 AT 06:26Bro this is the biggest joke since the Dogecoin moon. You think you’re rich because you tapped a screen 500 times? Nah you’re just the chump they used to pump the price then dumped on. I’ve seen the wallets. I’ve seen the trades. You’re not earning crypto - you’re fueling their yacht fund. Wake up.