Crypto Token Risk Assessment Tool

Token Risk Assessment

Risk Assessment Results

At first glance, Axioma Token (AXT) sounds like a promising gateway into real estate investing-no need for a down payment, no paperwork, just buy tokens and own property. But dig deeper, and the story unravels fast. As of October 2025, AXT trades around $0.90, with a claimed market cap of nearly $600 million. That number doesn’t add up. Not even close.

What Is Axioma Token (AXT) Really?

AXT is a token built on the Binance Smart Chain (BSC), following the BEP-20 standard. It’s marketed as the backbone of the FFSRO ecosystem, promising to connect everyday people to real estate investments through blockchain. But here’s the catch: there’s no proof it actually does.

Unlike RealT or Brickblock-projects that list actual properties, show lease agreements, and provide third-party audits-AXT offers zero documentation. No property addresses. No ownership records. No legal structure. Just a website and a token contract. The idea sounds good, but without transparency, it’s just noise.

The token’s total supply is fixed at 1 billion AXT, with about 655 million in circulation. That sounds solid-until you see the numbers behind it. Only 385 wallet addresses hold AXT. Three hundred and eighty-five people own a token with a $600 million market cap. That’s an average of over $1.5 million per holder. That’s not decentralization. That’s concentration. And it’s a textbook sign of market manipulation.

The Price Crash Nobody Talks About

On May 6, 2024, AXT hit an all-time high of $495.18. Today, it’s under $1. That’s a 99.82% drop in less than a year. What caused it? Not a market correction. Not a bear cycle. It was the truth catching up.

When the hype faded, the lack of real utility became obvious. No one was using AXT to buy property. No one was earning rental income from it. No one could verify what it even represented. The price didn’t fall because of market conditions-it fell because the foundation was sand.

Even more telling? CoinMarketCap reports zero 24-hour trading volume. Zero. How can a token with a $600 million market cap have no trades? The answer: the price is being faked. Some exchanges list it at $0.90, others at $1.26. That kind of inconsistency doesn’t happen in real markets. It happens in pump-and-dump schemes.

The Smart Contract Red Flag

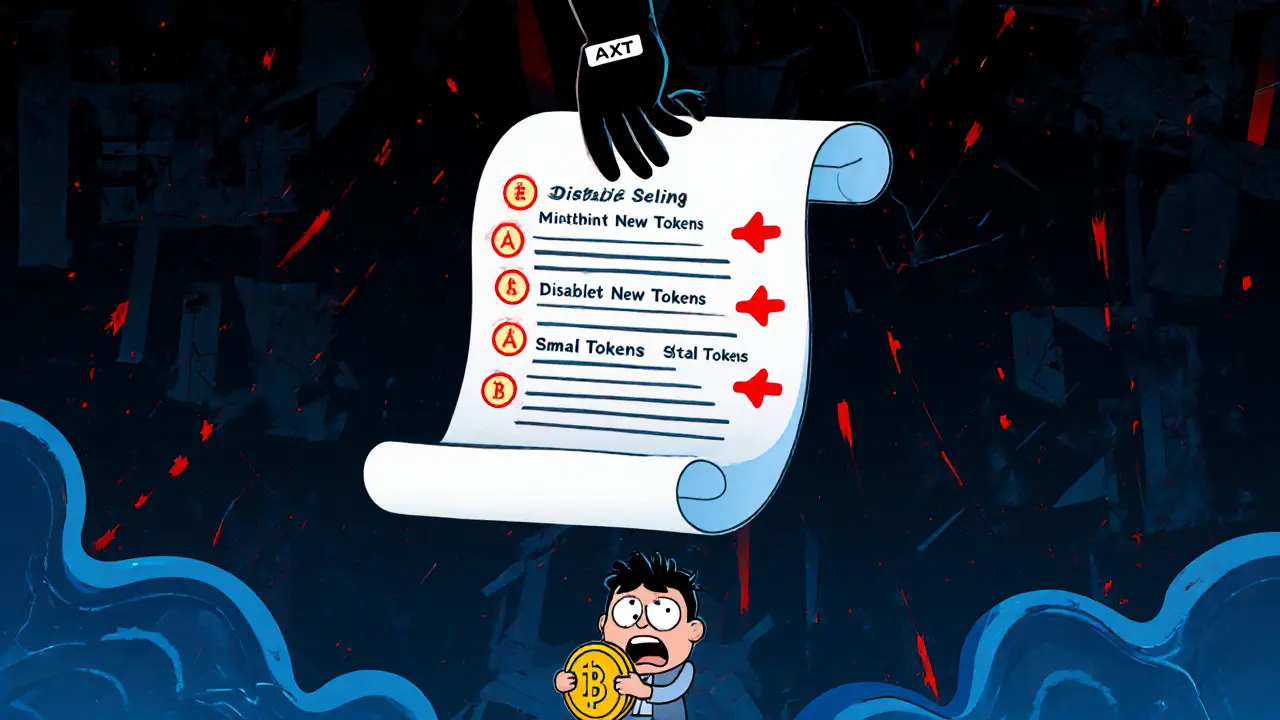

This is the most dangerous part: the AXT smart contract can be changed by its creator.

According to CoinMarketCap and Binance, the contract allows the team to:

- Disable selling entirely

- Change transaction fees

- Mint new tokens out of thin air

- Transfer any holder’s tokens

This isn’t a bug. This is a feature. And it’s a massive red flag.

Legitimate projects lock their contracts after launch. They use multi-sig wallets. They get audits from firms like CertiK or SlowMist. AXT does none of that. The fact that the contract is still editable means the team could walk away tomorrow, freeze all trades, and take your money with them. And there’s nothing you can do.

John Walden, Chief Analyst at CryptoSlate, called this pattern a "critical red flag for potential scam coins" in his 2023 report. He’s not alone. Experts at Messari have labeled tokens like AXT as "zombie tokens"-alive on paper, but dead in practice.

Where’s the Real Estate?

AXT claims to unlock real estate for small investors. But where are the properties? How many? What’s their value? Who owns them legally?

Zero answers.

Compare that to RealT, which in 2023 had over $30 million in U.S. properties tokenized-with public addresses, rental data, and investor reports. Or Tokenplace, which publishes quarterly audits. AXT doesn’t even have a whitepaper. No roadmap. No team names. No LinkedIn profiles. No company registration details.

In the real estate tokenization space, which PwC valued at $10.2 billion in 2023, AXT is invisible. It doesn’t compete-it’s a ghost.

No Community, No Future

Real crypto projects have communities. Reddit threads. Telegram groups. Twitter buzz. GitHub commits. AXT has none.

Search r/CryptoCurrency. Search r/Altcoin. Search Twitter. You’ll find scattered mentions, but no discussion. No questions. No success stories. Just silence.

Sarah Zhang’s 2023 study found that projects with real utility attract at least 1,000 active holders within six months. AXT has 385 total holders-and that’s been the same number for months. That’s not growth. That’s stagnation. Or worse, artificial inflation.

No one’s talking about AXT because no one’s using it. And if no one’s using it, it has no value.

What Do Experts Say?

CoinCheckup predicts AXT will drop another 25% to $0.29 by November 2025. That’s not a forecast-it’s a funeral notice.

Michael Grunstein from CoinDesk analyzed over 1,200 low-cap tokens and found that 92.7% of those with modifiable smart contracts and inflated market caps failed within 18 months. AXT fits that profile perfectly.

And then there’s the regulatory angle. The U.S. SEC fined REcoin Foundation $30 million in 2023 for selling unregistered securities disguised as real estate tokens. AXT doesn’t even pretend to comply with securities laws. No lawyer. No compliance team. No disclosure.

This isn’t just risky. It’s legally dangerous.

Should You Buy Axioma Token?

No.

Not because it might go down in price. But because it’s not a real investment. It’s a digital illusion. A card trick with blockchain as the backdrop.

If you’re looking to invest in real estate through crypto, go with projects that show you the property deeds, the rental payments, the audits. RealT. Brickblock. Tokenplace. They have track records. AXT has nothing but a price chart and a promise.

And that promise? It’s already broken.

What Happens If You Already Own AXT?

If you bought AXT at $495, you’re already down 99.8%. That’s not a loss-it’s a lesson.

If you bought it recently, don’t wait for a rebound. The smart contract is still editable. The team could vanish tomorrow. The price could drop to $0.01 overnight. There’s no safety net.

Exit while you can. Even if you lose money, you’ll lose less than if you wait for a miracle.

Don’t chase it. Don’t average down. Don’t hope. Just get out.

Eric Redman

November 1, 2025 AT 11:23Phyllis Nordquist

November 1, 2025 AT 17:28Brett Benton

November 2, 2025 AT 21:58David Roberts

November 3, 2025 AT 18:26Monty Tran

November 5, 2025 AT 15:43Beth Devine

November 6, 2025 AT 17:11Brian McElfresh

November 7, 2025 AT 00:12Hanna Kruizinga

November 7, 2025 AT 16:41David James

November 8, 2025 AT 01:14Shaunn Graves

November 9, 2025 AT 11:31Jessica Hulst

November 10, 2025 AT 09:11Kaela Coren

November 12, 2025 AT 01:00Nabil ben Salah Nasri

November 13, 2025 AT 18:30Debby Ananda

November 15, 2025 AT 06:15Vicki Fletcher

November 16, 2025 AT 19:10Nadiya Edwards

November 18, 2025 AT 15:31Malinda Black

November 19, 2025 AT 09:42