AOP Volatility & Token Risk Calculator

Understand AOP's Price Volatility

This calculator shows how token supply and trading volume affect volatility risk. Based on the article, AOP had a volume-to-float ratio of 1:213 during its spike, which is highly unstable.

Ark of Panda (AOP) isn’t another meme coin pretending to be revolutionary. It’s a crypto project built on the BNB Chain that tries to do two big things at once: turn real-world assets like property and art into digital tokens, and give users AI tools to create content around them. Sounds useful? Maybe. But the numbers tell a different story.

What AOP Actually Does

AOP stands for Ark of Panda. It’s a token with a total supply of 2 billion coins, but only 300 million are in circulation as of late 2025. That’s a tight float. The team behind it - around 15 to 20 people with backgrounds in finance, AI, and digital media - says AOP bridges physical assets and blockchain. Think of it like this: if you own a painting worth $500,000, you can split it into 10,000 digital tokens, each worth $50. Anyone can buy a piece of that painting on the AOP platform. That’s called real-world asset (RWA) tokenization.

But here’s the twist: AOP doesn’t just let you tokenize assets. It also gives you AI tools to generate social media posts, videos, and articles about those assets. So if you own a token tied to a luxury watch, the AI might help you write a post like: "Just bought my slice of this 1968 Rolex. Here’s why it’s a better investment than gold."

It’s not about trading the watch. It’s about trading the story around it. That’s unusual. Most RWA projects - like Ondo Finance or MakerDAO - focus only on the asset side. Most AI coins - like Fetch.ai - focus only on the tech side. AOP tries to do both. That’s its main selling point.

The Numbers Don’t Add Up

On paper, AOP looks tiny. Its market cap hovered around $22 million in October 2025. That’s less than 0.14% of the entire RWA sector, which was worth over $15 billion. Compare that to Ondo Finance, which has a market cap of $1.8 billion. AOP is a speck.

But then came the volume.

In one single day - October 14, 2025 - AOP hit $6.4 billion in trading volume on Binance Alpha. That’s more than Bitcoin traded that day. How? Because Binance ran a competition. Traders who made the most trades in AOP won free tokens. People started buying and selling AOP back and forth just to climb the leaderboard. One trader on Twitter said they made 3.2 ETH from the game. That’s real money. But it’s not investment. It’s gambling.

Once the competition ended, the volume collapsed. Trading volume dropped to $127 million in the next 24 hours. The price, which had hit an all-time high of $0.148, crashed 43% in a week while the rest of the market only dropped 7%. That’s not a correction. That’s a freefall.

Why It’s So Volatile

There are two big reasons AOP swings like a pendulum.

First: supply. Only 300 million tokens are out there. That’s a tiny amount compared to the volume it moved. Analysts at Delphi Digital say a healthy token should have a volume-to-float ratio under 1:10. AOP hit 1:213. That means for every token in circulation, there were 213 trades happening. That’s a recipe for manipulation.

Second: ownership. A small group of wallets holds most of the circulating supply. When those wallets dump, the price crashes. When they buy, it pumps. There’s no real demand from people using the platform - just traders chasing rewards.

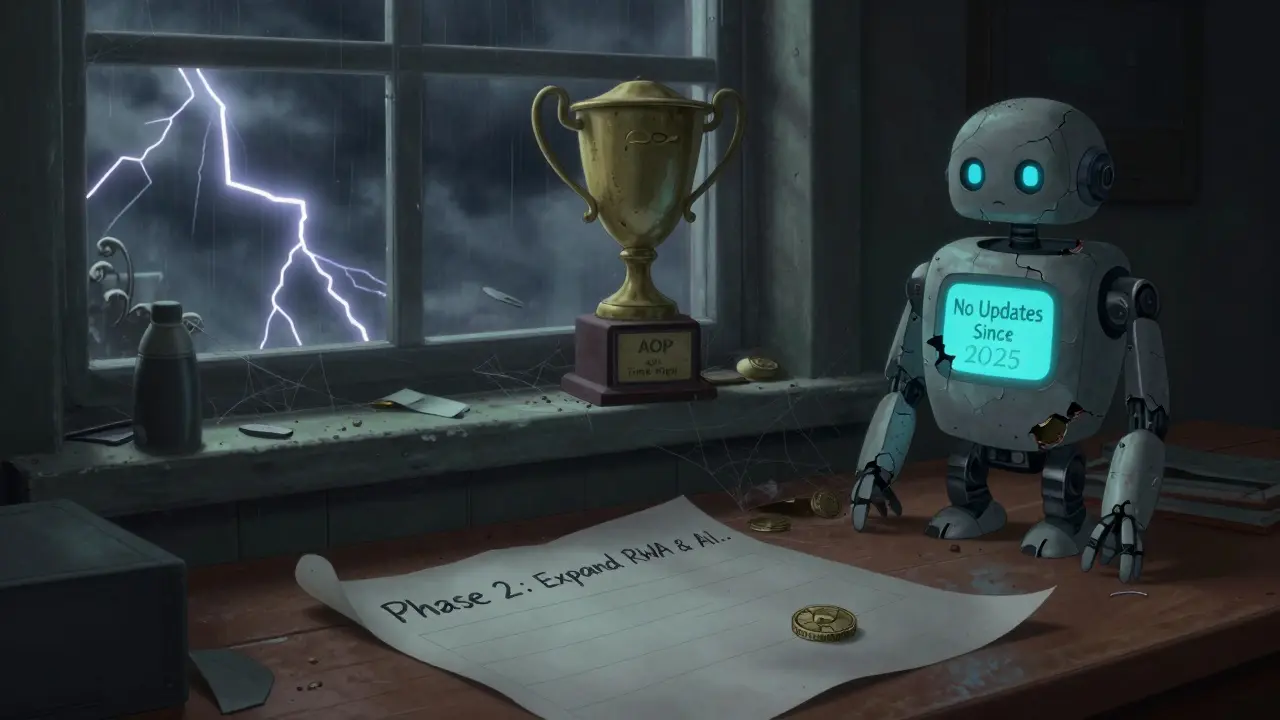

Users on Reddit called it "pure gambling." CoinMarketCap users gave it a 2.7 out of 5 stars, mostly complaining about "pump and dump" patterns. There’s no active Discord. No GitHub repo. No developer updates. If you’re looking for a project with a strong community building real tools, AOP isn’t it.

Who Is This For?

AOP doesn’t feel built for beginners. There’s no easy onboarding. No tutorials. No help center. The platform seems aimed at professional asset managers who already know how to handle real estate or fine art, and who are also comfortable with blockchain. But even then, the AI tools are vague. No one knows what models they use. What prompts work? What outputs can you expect? The documentation is bare.

It’s also unclear how the tokenization process works. How do you prove you own the real asset? Who verifies it? What happens if the asset gets damaged or stolen? There are no answers. That’s a red flag for any RWA project. If you can’t trust the link between the token and the asset, the token has no value.

The AI side is just as murky. Is it GPT-4? A custom model? Does it generate content in real time? Is it trained on user data? No details. That’s not innovation. That’s smoke and mirrors.

The Bigger Picture

RWA tokenization is real. It’s growing fast. By Q3 2025, over $15 billion in real assets were on-chain. That’s not hype. That’s institutional adoption. But AOP isn’t part of that wave. It’s riding a wave of exchange incentives and trader speculation.

The AI content side? That’s also real. The market for AI-generated media is projected to hit $126 billion by 2026. But again, AOP doesn’t lead here. It’s just slapping an AI label on a platform that’s more about trading than creation.

The SEC has started cracking down on projects that claim to back tokens with real assets. If AOP ever tries to expand beyond BNB Chain, it could face legal pressure. Right now, it’s operating in a gray zone - and that’s fine if you’re a trader looking for a quick flip. It’s dangerous if you think you’re investing.

Is AOP Worth It?

Here’s the truth: AOP has no long-term utility. It doesn’t solve a real problem. It doesn’t have a strong team behind it. It doesn’t have a community. It doesn’t have transparency. What it has is volatility, hype, and a trading competition that fooled people into thinking it was a breakout.

If you’re a trader who likes high-risk, high-reward plays and knows how to exit fast - maybe AOP gave you a chance to make money during the Binance event. But if you’re holding it now, you’re holding a volatile, illiquid asset with no clear path forward.

The team says they plan to "expand RWA tokenization and AI functionalities post-launch." But that was said months ago. No roadmap. No dates. No updates. That’s not a project. That’s a promise with no delivery.

Ark of Panda isn’t the future of asset ownership. It’s a cautionary tale about how exchange incentives can distort markets, how AI buzzwords can mask emptiness, and how a tiny token with a big volume can fool even smart people into thinking it’s something it’s not.

Don’t invest in AOP because it’s "the next big thing." Invest in it only if you’re ready to gamble on a coin that could drop 50% in a week - and never recover.

What is Ark of Panda (AOP) crypto used for?

AOP is designed to tokenize real-world assets like real estate and fine art into digital tokens on the BNB Chain, allowing fractional ownership. It also offers AI tools to generate content about those assets. But in practice, most trading is speculative, driven by exchange competitions rather than actual asset use.

Is AOP a good investment?

No, not as a long-term investment. AOP has extreme volatility, low liquidity outside of incentivized trading, and minimal real-world adoption. Its price movements are tied to exchange giveaways, not utility. Experts warn it’s prone to manipulation and lacks transparency in both asset backing and AI tools.

Why did AOP’s trading volume spike to $6.4 billion?

The spike happened during a Binance Alpha trading competition from October 10-17, 2025. Traders earned AOP tokens by making the most trades - even if they were just buying and selling the same tokens back and forth. This artificial activity inflated volume, not demand. Once the contest ended, volume collapsed.

Can I buy AOP on major exchanges?

Yes, AOP is listed on Binance Alpha and a few smaller exchanges like LBank and WEEX. But it’s not available on major platforms like Coinbase or Kraken. Its limited listing means lower liquidity and higher risk for retail buyers.

How does AOP compare to other RWA tokens like ONDO?

Ondo Finance (ONDO) has a market cap of $1.8 billion and is backed by institutional-grade asset managers. It’s focused purely on tokenizing bonds, real estate, and funds with strong legal and compliance frameworks. AOP has a $22 million market cap, no institutional backing, and adds unproven AI tools. ONDO is a financial product. AOP is a trading gimmick.

Is AOP safe to use?

Only if you understand the risks. There’s no public audit of its smart contracts, no GitHub activity, and no community support. The AI tools are unverified. Asset backing is unconfirmed. If you’re not a professional trader who can exit quickly, you’re exposing yourself to high risk with no safety net.

What’s the current price of AOP?

As of late October 2025, AOP traded between $0.062 and $0.081. It hit an all-time high of $0.148 on October 14, 2025, but dropped over 40% in the following week. Prices change rapidly due to low liquidity and high volatility.

Does AOP have a whitepaper or technical documentation?

No official whitepaper is publicly available. CoinMarketCap lists basic tokenomics - total supply, circulating supply - but no technical details on how RWA tokenization works, what AI models are used, or how smart contracts are secured. This lack of transparency is a major red flag.

Lore Vanvliet

December 6, 2025 AT 09:16Scott Sơn

December 7, 2025 AT 03:44Frank Cronin

December 7, 2025 AT 12:31Nicole Parker

December 8, 2025 AT 14:04Elizabeth Miranda

December 9, 2025 AT 05:51Krista Hewes

December 11, 2025 AT 00:25Noriko Robinson

December 12, 2025 AT 20:49Mairead Stiùbhart

December 13, 2025 AT 00:27Doreen Ochodo

December 13, 2025 AT 01:55Yzak victor

December 14, 2025 AT 01:11Holly Cute

December 14, 2025 AT 19:45Neal Schechter

December 14, 2025 AT 22:13Madison Agado

December 15, 2025 AT 09:42Tisha Berg

December 16, 2025 AT 09:51Billye Nipper

December 16, 2025 AT 19:28Roseline Stephen

December 17, 2025 AT 17:37Jon Visotzky

December 18, 2025 AT 04:33Isha Kaur

December 18, 2025 AT 15:54Glenn Jones

December 20, 2025 AT 15:10