AKAS (AS) is a cryptocurrency that launched on May 29, 2025, with bold claims: a fully on-chain DeFi protocol built to fix the centralization problems of older projects like OlympusDAO. It says it’s not just another coin - it’s a Full-chain Resonance Protocol designed for true community ownership. But behind the fancy tech terms and glowing social media posts, there are serious red flags that could cost you everything.

What AKAS claims to be

AKAS stands for Anima Karmic Autonomous Synchrony. The team says it’s based on OlympusDAO 4.0 but upgraded to work fully on-chain - meaning no middlemen, no hidden rules, no central team pulling strings. Everything runs on smart contracts. They call this the COC model - Co-Creation - where every participant is a co-founder, not just an investor.

Their big selling point? No private sales. No whitelists. No bots. Everyone gets the same shot. If you show up during the Genesis LP launch, you can lock your funds and get AKAS tokens in return. Early participants get up to a 30% bonus, but that drops by 0.5% every day. That creates pressure: join now or miss out.

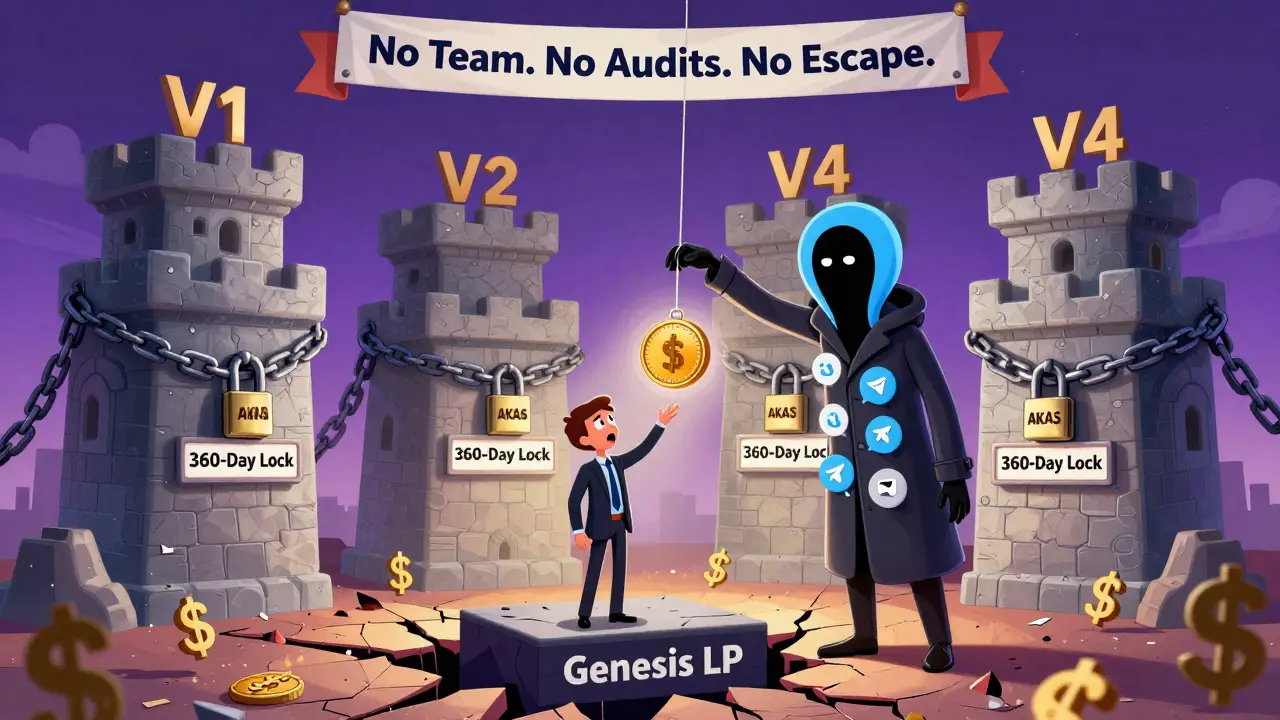

There are four participation tiers - V1 to V4. The higher your tier, the more voting power you get in the DAO. To reach V4, you need to stake your tokens for 360 days. That’s over a year. The project says this locks in long-term commitment. Critics say it locks in your money so you can’t escape if things go wrong.

How AKAS tries to look legit

AKAS has a polished online presence. There’s a Twitter account (@AKASOfficial_), a Facebook page (AKASOfficialFB), and a busy Telegram group (t.me/akasdao). The website looks professional. The whitepaper uses technical language that sounds smart. They mention things like "global consensus," "trustless financial order," and "decentralized asset circulation."

They even track their stats: as of October 2025, AKAS trades at $9.08 with $2.73 million in daily volume. That sounds impressive until you realize most major coins trade billions daily. AKAS is tiny. And its price dropped 2.05% in the last 24 hours - normal volatility? Maybe. But with only five months of history, there’s no real trend to analyze.

The scam warnings are loud and clear

Here’s the problem: multiple independent investigators have flagged AKAS as a potential "pig butchering" scam. That’s not a typo. Pig butchering is a type of crypto fraud where scammers build fake trust over weeks or months - chatting with you, sharing fake profits, showing fake charts - until you invest big. Then, the platform vanishes, your money disappears, and no one answers your messages.

Investors have already reported losses. Researchers say the pattern matches: aggressive FOMO tactics (that daily bonus drop), long staking periods that trap your cash, no real team behind the project, and zero transparency about who’s running it. The team claims to be from Tórshavn, Denmark, but there’s no public record of a registered company there. No legal entity. No audited smart contracts. No known developers.

And here’s the kicker: AKAS doesn’t even have a working product. No real DeFi app. No live yield farming. No token utility beyond trading. It’s just a token on a blockchain, with promises of future features that may never come.

Why the "fair launch" claim is misleading

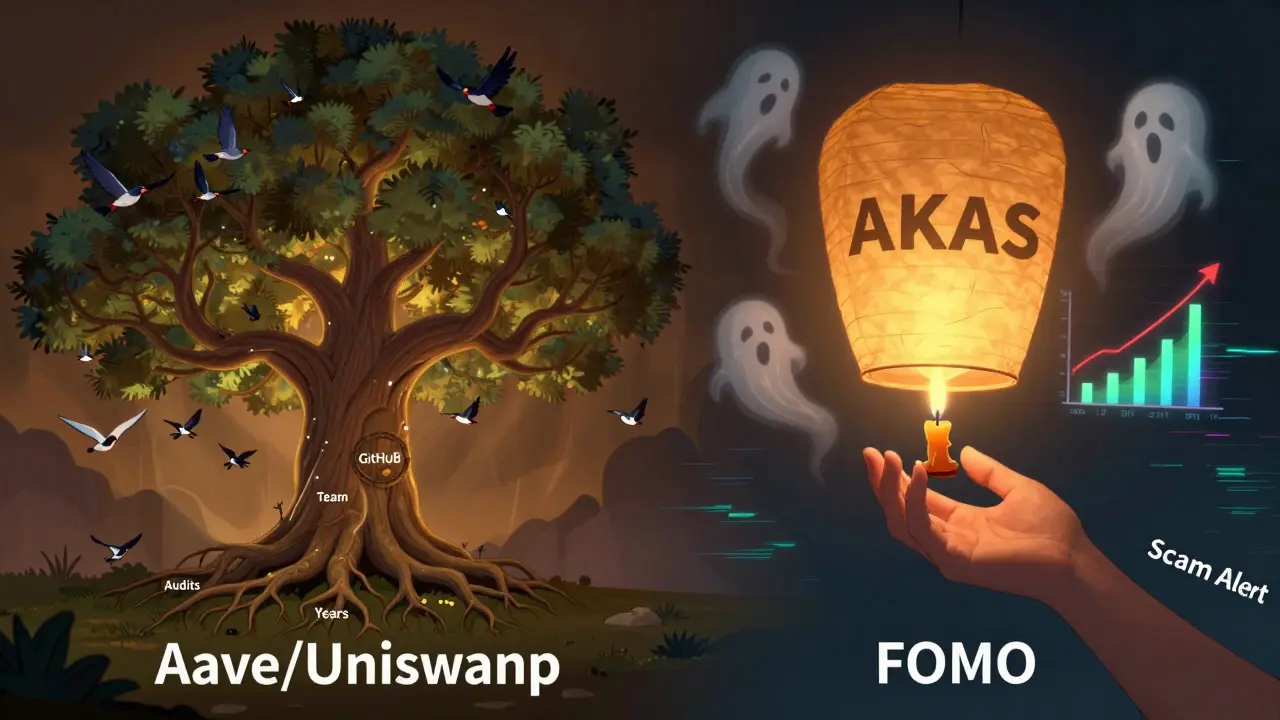

AKAS says it’s fair because no insiders got early access. But that’s not enough. Fair doesn’t mean safe. Many legitimate projects also avoid private sales. What makes AKAS different is the lack of accountability. If OlympusDAO had a similar launch, you could look up its team, its history, its audits. AKAS has none of that.

Also, the 360-day staking lock isn’t a feature - it’s a trap. Real DeFi protocols let you withdraw your funds anytime. If you’re forced to lock your money for a year, it’s usually because the project needs time to run away with it. Once your funds are locked, you can’t panic-sell. And if the team disappears, you’re stuck with worthless tokens.

What you’re really buying

When you buy AKAS, you’re not buying a piece of a decentralized finance system. You’re buying a bet on a group of anonymous people who may not even exist. There’s no roadmap with milestones. No GitHub activity. No code reviews. No audits from firms like CertiK or SlowMist.

The only thing moving is the price - and that’s being pumped by bots and early participants trying to cash out. The $2.73 million daily volume? That’s likely wash trading - people buying and selling to themselves to make it look popular.

Compare this to real DeFi projects like Uniswap or Aave. They’ve been around for years. They have teams you can email. They’ve been audited. Their code is public. Their tokenomics are transparent. AKAS has none of that.

Should you invest in AKAS?

No.

Not because it’s complicated. Not because it’s too new. But because the warning signs are overwhelming. The pig butchering report isn’t rumor - it’s based on real investor testimonies and pattern matching from past scams. The project’s structure mirrors known fraud models: urgency, long locks, anonymity, fake legitimacy.

If you’ve already invested, don’t add more. If you’re thinking about it, walk away. Even if the project somehow survives, the risk isn’t worth the reward. You’re not investing in innovation - you’re gambling on a ghost.

What to do instead

If you want to get into DeFi, start with projects that have proven track records. Look for:

- Public, audited smart contracts

- Known development teams with LinkedIn profiles

- Real usage - not just trading volume

- Community discussions on Reddit, Discord, or GitHub - not just Telegram hype

- At least two years of operation

Projects like Curve, Synthetix, or Aave have survived multiple market cycles. They’ve been attacked, tested, and still run. AKAS hasn’t even survived five months without a major red flag.

There’s no shame in waiting. The best crypto investments aren’t the ones that promise the most - they’re the ones that prove they’re real.

Final warning

Don’t let FOMO trick you. That 30% bonus? It’s not a gift. It’s bait. The longer you wait, the less you get - but the more you risk. That’s not how real finance works. Real finance gives you time to think. AKAS wants you to act - fast.

If something sounds too good to be true, it is. And in crypto, that’s not just a saying - it’s a survival rule.

Alison Fenske

December 22, 2025 AT 05:05they’re not building a protocol. they’re building a trap with glitter on it.

Tyler Porter

December 23, 2025 AT 03:41Luke Steven

December 24, 2025 AT 06:19This isn't about DeFi. It's about our need to feel like we're part of something revolutionary. But revolutions need bones. AKAS has no skeleton. Just a skin of buzzwords and a heartbeat that's just a bot pinging a server.

Ellen Sales

December 25, 2025 AT 13:51Vijay n

December 25, 2025 AT 21:51Earlene Dollie

December 26, 2025 AT 04:01Dusty Rogers

December 27, 2025 AT 23:38Kevin Karpiak

December 28, 2025 AT 22:00Amit Kumar

December 29, 2025 AT 16:26chris yusunas

December 29, 2025 AT 20:51Mmathapelo Ndlovu

December 30, 2025 AT 11:52Jordan Renaud

December 30, 2025 AT 18:16roxanne nott

December 31, 2025 AT 19:19Rachel McDonald

January 1, 2026 AT 10:12Collin Crawford

January 3, 2026 AT 07:44Jayakanth Kesan

January 5, 2026 AT 05:17Aaron Heaps

January 6, 2026 AT 00:00