SEC Crypto Fines: What Happens When the Regulators Step In

When the SEC crypto fines, penalties issued by the U.S. Securities and Exchange Commission against crypto companies for violating federal securities laws. Also known as crypto enforcement actions, these fines aren’t just paperwork—they shut down platforms, freeze assets, and send shockwaves through the market. It’s not about catching small-time traders. The SEC targets platforms that sell tokens like stocks without registering them, projects that promise returns without disclosing risks, and exchanges that act like brokerages but ignore the rules.

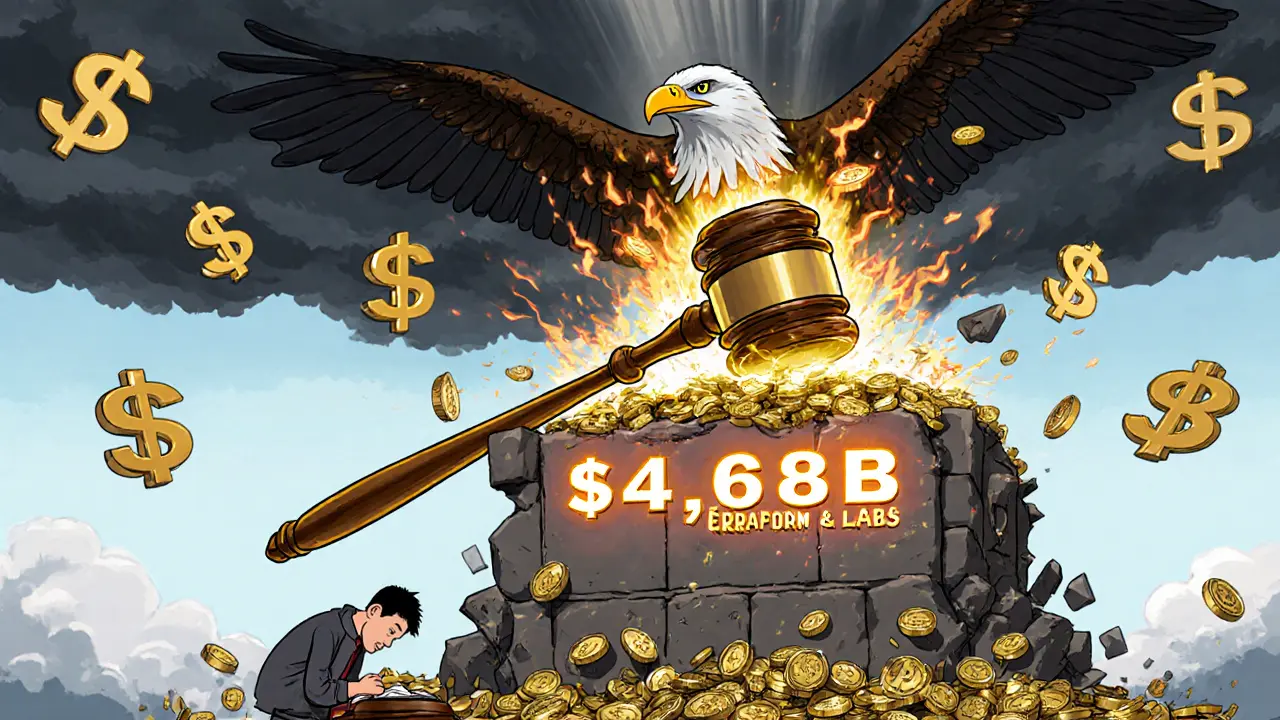

Take Coinbase, a major U.S. crypto exchange that faced SEC legal action over unregistered securities offerings. Or Ripple, the company fined $1.25 billion for selling XRP as an unregistered security. These aren’t outliers. The SEC has gone after over 30 crypto firms since 2020. The pattern? If a token behaves like an investment contract—where people put money in expecting profits from others’ work—it’s a security. And if you’re selling it without paperwork, you’re breaking the law.

It’s not just exchanges. Token creators, DeFi protocols, and even influencers who promote coins without disclosing payments have been hit. The FATF greylist, a global list of jurisdictions with weak anti-money laundering controls, ties into this. Countries on that list face stricter scrutiny, and U.S. regulators use that data to track cross-border crypto flows. Meanwhile, Singapore crypto compliance, a framework requiring exchanges to get licensed and follow strict AML rules, shows how other regions are handling it differently. But in the U.S., the message is clear: if you’re in crypto, you’re under the microscope.

What does this mean for you? If you’re holding a token that promised high returns with no clear utility, you’re already in a risky zone. If you’re trading on a platform that doesn’t disclose its legal status, you’re playing with fire. The SEC doesn’t care if you thought it was safe. They care if the rules were broken. And they’ve got the power to take down entire projects overnight.

The posts below don’t just report on these fines—they dig into the fallout. You’ll find real cases: exchanges that vanished after regulatory pressure, tokens that collapsed because the SEC labeled them securities, and projects that tried to hide behind vague whitepapers. You’ll see what happens when a crypto project ignores compliance, and why some teams vanish before the fine even lands. This isn’t theory. It’s what’s happening right now.