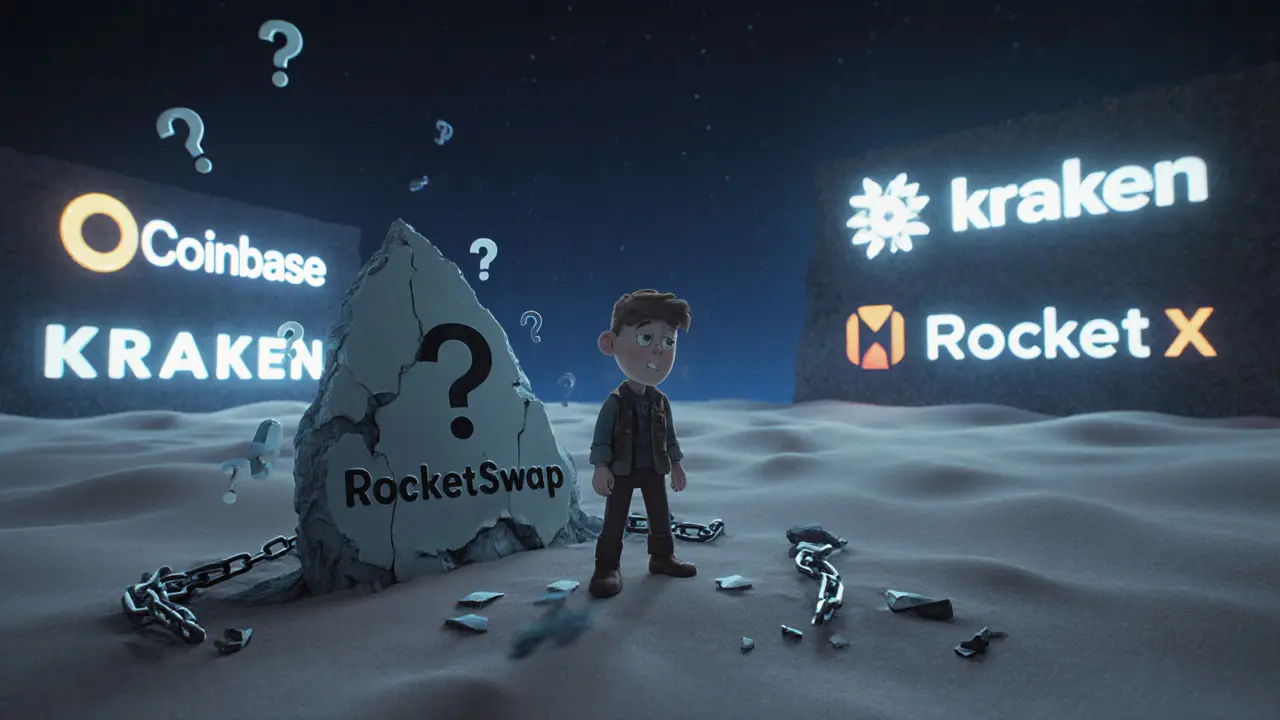

RocketSwap Review: What You Need to Know Before Trading on This DEX

RocketSwap, a decentralized exchange built on the Binance Smart Chain that lets users swap tokens without intermediaries. Also known as RSWAP, it’s one of many DEXs trying to carve out space in a crowded market—but not all are built to last. Unlike big names like Uniswap or PancakeSwap, RocketSwap doesn’t have a long track record, transparent team, or deep liquidity pools. That doesn’t mean it’s a scam—but it does mean you need to ask harder questions before you trade.

Most users who end up on RocketSwap are drawn by high APYs on yield farms or the promise of new token listings. But here’s the catch: many of those tokens have zero real utility, tiny market caps, and liquidity that vanishes overnight. Binance Smart Chain, a blockchain known for low fees and fast transactions, but also for attracting high-risk projects is the foundation here. That’s not inherently bad—it’s why projects like RocketSwap exist—but it means you’re trading in a space where scams and rug pulls are common. You’ll find similar setups in posts about MM Finance, Axioma Token, and LARIX—all projects that looked promising on the surface but lacked the backing to survive.

Decentralized exchange, a platform where users trade crypto directly from their wallets without a central authority isn’t just a tech term—it’s a responsibility. When you use RocketSwap, you’re not just swapping tokens; you’re trusting smart contracts that anyone can update, liquidity pools that can be drained, and teams that might disappear. There’s no customer support, no chargebacks, and no insurance. If you lose your money, it’s gone. That’s why checking contract audits, token distribution, and liquidity lock status isn’t optional—it’s survival.

What you’ll find in the posts below aren’t just reviews—they’re real case studies. You’ll see how users got burned on low-liquidity DEXs, how to spot fake airdrops tied to platforms like RocketSwap, and what red flags to watch for before you connect your wallet. Some posts cover similar platforms like Escodex and MM Finance, where the same patterns repeat: zero supply, no audits, and hype-driven price spikes. This isn’t about FOMO. It’s about knowing when to walk away.