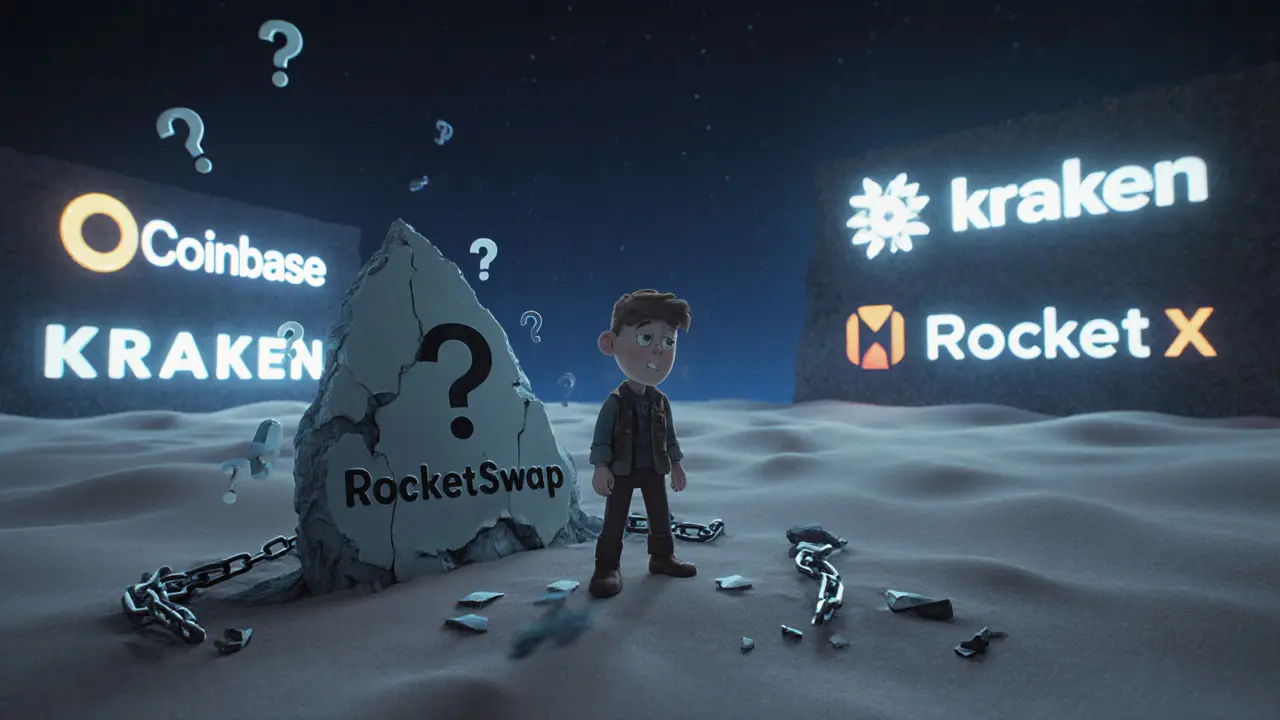

RocketSwap Crypto Exchange: What It Is and What You Need to Know

When you hear RocketSwap, a decentralized crypto exchange built on the Binance Smart Chain that lets users trade tokens without a middleman. Also known as a DEX, it’s one of many platforms trying to replace traditional crypto exchanges with open, trustless systems. Unlike centralized platforms like Binance or Coinbase, RocketSwap doesn’t hold your funds. You trade directly from your wallet using smart contracts. That means no KYC, no account freezes, and no third-party risk—but also no customer support if something goes wrong.

RocketSwap fits into a bigger world of decentralized exchanges, platforms that use automated market makers instead of order books to set prices. This is the same model used by Uniswap, PancakeSwap, and SushiSwap. These DEXs rely on liquidity pools—groups of users who lock up tokens to enable trading—and reward them with trading fees. RocketSwap follows this pattern, but it’s not as widely used or as liquid as its bigger rivals. That’s a red flag: low liquidity means slippage, failed trades, and price manipulation risks.

What sets RocketSwap apart? Not much. Most of its features are standard: token swaps, staking, and yield farming. But its tokenomics are unclear. There’s no public audit, no team disclosure, and no roadmap. Compare that to Binance Smart Chain, a blockchain network optimized for low-cost, fast transactions that hosts hundreds of DeFi apps, which is a solid foundation—but not enough to make RocketSwap trustworthy on its own. Many users end up here after chasing high APYs on new tokens, only to find those tokens are worthless or the pool is drained.

You’ll find posts here about similar platforms like MM Finance and Escodex—both of which turned out to be risky or inactive. That’s not a coincidence. The same crowd looking for quick gains on RocketSwap is also chasing obscure airdrops like LARIX or AXT. These aren’t investments. They’re gambles built on hype, not utility. If you’re trading on RocketSwap, you’re not just betting on a token—you’re betting on the platform staying alive long enough for you to exit.

There’s no official website, no whitepaper, and no verified social media. That’s not normal. Even meme coins have a Discord. If you’re thinking of using RocketSwap, check the contract address on BscScan. Look for renounced ownership, locked liquidity, and real trading volume. If those are missing, walk away. The crypto space is full of places that look like exchanges but are really exit scams waiting to happen. RocketSwap might be one of them. Or it might not. Either way, you need to know what you’re getting into before you connect your wallet.