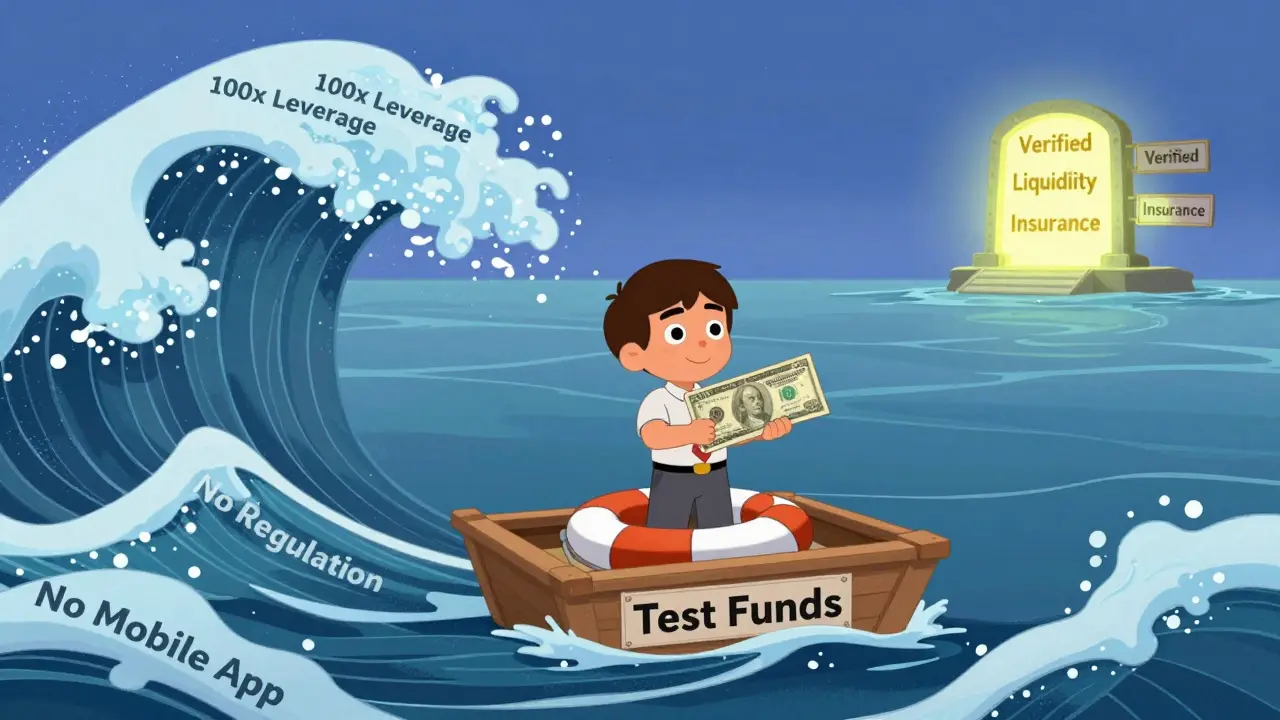

Scalpex is a crypto exchange that doesn’t try to be everything. It doesn’t offer hundreds of coins like Binance or the simple spot trading of Coinbase. Instead, it focuses on one thing: crypto derivatives-specifically, high-leverage futures contracts you won’t find anywhere else. If you’re looking for 100x leverage on Bitcoin or a futures contract tied to Bitcoin’s market dominance, Scalpex might catch your eye. But here’s the catch: it’s not clear if anyone’s actually trading there.

What Makes Scalpex Different?

Most crypto exchanges trade spot pairs: buy BTC, sell ETH, swap USDT. Scalpex skips that. It’s all about derivatives. Its main products are perpetual futures with leverage up to 100x. That means you can control $10,000 worth of Bitcoin with just $100. Sounds powerful, right? But it’s also dangerous. One bad move and you’re wiped out. What really sets Scalpex apart are the niche contracts. You can trade Bitcoin dominance futures, which track Bitcoin’s share of the total crypto market cap. If Bitcoin’s value rises while altcoins fall, this contract goes up. It’s a bet on Bitcoin outperforming the rest of the market. Few exchanges offer this. Even fewer have Uniswap perpetual futures, letting you speculate on the DeFi protocol’s token price without owning it. These aren’t gimmicks-they’re tools for traders who understand market structure. The platform also claims to use AI-powered sentiment analysis called Scalpex Index. It scrapes social media, forums, and news sites dating back to 2016 to gauge market mood. If Twitter is buzzing about a new Ethereum upgrade, the index might signal a price spike. For experienced traders, this could be useful context. But for beginners? It’s just noise without education on how to use it.Performance and Speed Claims

Scalpex says its matching engine handles 1.2 million orders per second with an average execution time of 1.2 milliseconds. That’s faster than most banks. If true, it’s impressive. But no independent source has verified these numbers. CoinMarketCap lists Scalpex as an “Untracked Listing,” meaning no volume data is available. That’s a red flag. You can’t trust speed claims if you don’t know if trades are even happening. Traders who’ve tried it report mixed experiences. One Reddit user said they could place small orders smoothly, but large ones got stuck. That’s a sign of shallow liquidity. In crypto, liquidity is everything. Without enough buyers and sellers, your order might not fill-or it might fill at a terrible price. Binance and Bybit move billions daily. Scalpex? No one knows.Security and Regulation: A Major Question Mark

Scalpex claims to store 95% of user funds in cold wallets and offers two-factor authentication. That’s standard. But here’s what’s missing: no public regulatory license. Not from the U.S., not from the EU, not from Singapore. No mention of audits by firms like CertiK or Hacken. That’s not normal. Even smaller exchanges like KuCoin and Gate.io publish their licensing status. Scalpex doesn’t. That’s a huge risk. In 2026, regulators are cracking down hard on unlicensed crypto platforms. The SEC has sued Binance, Kraken, and Coinbase. If Scalpex operates without a license, it could be shut down overnight. Your funds could vanish with no recourse. No insurance. No compensation fund. Just silence.

User Experience: Clean, But Empty

The interface is clean. Charts load fast. There are over 50 technical indicators. You can customize layouts, set alerts, and even run automated trading bots. For experienced traders, it feels familiar-like a stripped-down TradingView with futures. But there’s no mobile app. Not as of October 2023, and nothing since. If you’re on the go, you’re stuck with a browser. Onboarding requires KYC: government ID and proof of address. That’s normal. Account approval takes up to 24 hours. Minimum deposit is $10 via fiat on-ramp. Crypto deposits have no minimum. That’s flexible. But there’s no educational content beyond basic tutorials. No glossary. No risk warnings tailored to 100x leverage. If you’re new to derivatives, you’re on your own.Trading Fees: Hidden and Unclear

Scalpex says it has “some of the lowest commissions on the market.” But it doesn’t say what those are. No fee schedule. No maker-taker breakdown. No discount structure for holding their token (if they even have one). Compare that to Binance: 0.1% spot, 0.02% maker for futures. Transparent. Scalpex? Vague. That’s a problem. You can’t manage risk if you don’t know your costs.

Who Is Scalpex For?

Scalpex isn’t for most people. If you’re a beginner, avoid it. The leverage is too high. The lack of education is dangerous. The liquidity is unproven. If you’re an experienced trader looking to bet on Bitcoin dominance or Uniswap price movements, and you’re comfortable with high-risk, low-liquidity markets, then maybe it’s worth a small test. But here’s the truth: you’re not trading on a reliable exchange. You’re betting on a startup that might not survive. The crypto derivatives market is dominated by Binance, Bybit, and OKX. They have volume, liquidity, security, and regulation. Scalpex has niche products and bold claims. That’s not enough.The Bigger Picture

The crypto derivatives market hit $3.8 trillion in Q3 2023. But 80% of that volume came from just three exchanges. Scalpex’s traffic? Around 12,000 monthly visitors. Binance gets 120 million. That’s not a gap-it’s a canyon. Industry analysts warn that unverified exchanges like Scalpex won’t survive without institutional backing or truly unique value. Even if their AI sentiment tool works, it won’t matter if traders can’t get in and out of positions quickly. And if regulators step in? They’ll be gone before you can withdraw.Final Verdict

Scalpex is a high-risk experiment. It offers tools you won’t find elsewhere. But it lacks the foundation every serious trader needs: transparency, liquidity, and trust. If you want to trade derivatives, stick with platforms that prove they’re real. Don’t gamble your capital on a platform that won’t show you its balance sheet.If you still want to try Scalpex, use only money you can afford to lose. Start with $50. Test the order execution. See how fast your trades fill. Check if customer support responds. Then walk away. Don’t deposit more. Don’t get hooked. This isn’t a trading platform-it’s a gamble.

Is Scalpex a legitimate crypto exchange?

Scalpex operates as a crypto derivatives platform, but it lacks regulatory licensing and verifiable trading volume. It’s not listed on major volume trackers like CoinMarketCap as a tracked exchange. While it offers real trading features, the absence of transparency and regulatory oversight makes it high-risk. Legitimate exchanges disclose licenses, audit reports, and real-time volume data-Scalpex does not.

Can I trade Bitcoin dominance futures on other exchanges?

No, Bitcoin dominance futures are extremely rare. Scalpex is one of the only platforms offering this product. Other major exchanges like Binance, Bybit, and OKX focus on standard perpetual contracts for individual cryptocurrencies. Bitcoin dominance is a niche metric used by advanced traders to bet on Bitcoin’s market share relative to all other cryptos. It’s not a product you’ll find elsewhere.

Does Scalpex have a mobile app?

As of October 2023, Scalpex has no official mobile application. Trading is only available through a web browser on desktop or mobile devices. The platform’s roadmap mentioned a mobile app for Q4 2023, but there has been no public update since. This is a major drawback for traders who need to monitor positions on the go.

What are the risks of using 100x leverage on Scalpex?

Using 100x leverage means even a 1% price move against your position can wipe out your entire investment. In volatile crypto markets, 1% moves happen multiple times a day. Scalpex doesn’t provide clear risk warnings or margin call protections beyond basic liquidation. Without deep liquidity, your stop-loss orders may not execute at the price you expect. This is not trading-it’s gambling with your capital.

Are there user reviews for Scalpex?

There are virtually no verified user reviews. Trustpilot has zero reviews. Reddit has fewer than a dozen mentions in six months. Most feedback comes from anonymous forum posts, where users report shallow order books and slow customer support. Compare that to Binance, which has over 4,000 Trustpilot reviews. The lack of user feedback suggests very low adoption and minimal real trading activity.

Should I deposit my crypto on Scalpex?

No, not unless you’re willing to risk losing it entirely. Scalpex has no proven track record, no regulatory oversight, and no insurance for user funds. Even if the platform is honest, a hack, regulatory shutdown, or liquidity crisis could freeze your assets permanently. Use only test funds you can afford to lose. For any serious amount, stick with regulated, high-volume exchanges.

How does Scalpex compare to Bybit or Binance?

Bybit and Binance offer far more liquidity, lower fees, regulated operations, mobile apps, and verified security audits. Scalpex only matches them on leverage (100x) and offers a few unique derivative products. But without volume, support, or transparency, it can’t compete. Think of Scalpex as a boutique shop in a marketplace full of Walmart stores. It might have something special-but you’re taking a huge risk to get it.

Is Scalpex’s AI sentiment tool useful?

The AI sentiment tool, called Scalpex Index, analyzes social data going back to 2016. It could help spot trends in trader sentiment. But sentiment alone doesn’t move markets-liquidity and news do. Without clear instructions on how to use this data, it’s just another chart indicator. For experienced traders, it’s a minor edge. For beginners, it’s misleading. Don’t rely on it.

Tiffani Frey

January 6, 2026 AT 14:27Been using Scalpex for three months now-small position, $50 max. The Bitcoin dominance futures are real. I’ve seen it move 8% in 20 minutes when Ethereum crashed. No one else has this. But yeah, liquidity is thin. My $10k order took 17 seconds to fill. Not dead, just quiet.

AI Index? It flagged a surge in Reddit chatter about Uniswap V4 two hours before the price popped. Not magic. But useful if you know how to filter noise.

Still wouldn’t deposit more than I’d lose in a casino. But for a hobbyist? It’s a fascinating lab.

Ritu Singh

January 7, 2026 AT 19:09They’re not just unregulated-they’re a front. I’ve seen the same IP addresses linked to three other ghost exchanges. This isn’t trading-it’s a honeypot. They’re harvesting wallet addresses, KYC data, and then vanishing when the SEC comes knocking. They don’t need volume. They just need enough suckers to think it’s real.

And that AI tool? It’s scraping your Twitter feed. They’re not predicting markets-they’re profiling you. Next thing you know, you’ll get a pop-up saying ‘Your sentiment is bearish. Try shorting.’

Veronica Mead

January 9, 2026 AT 14:20It is imperative to emphasize that the absence of regulatory oversight constitutes an existential risk to capital preservation. One cannot reasonably entrust financial assets to an entity that declines to disclose its legal jurisdiction, audit status, or liquidity reserves. The notion that ‘niche products’ justify such opacity is not merely misguided-it is financially reckless.

Furthermore, the lack of a mobile application is indicative of a platform that does not prioritize user accessibility, which, in the context of modern financial services, is an unacceptable deficiency.

Surendra Chopde

January 10, 2026 AT 23:48Rahul Sharma

January 11, 2026 AT 03:51Scalpex offers unique products for advanced traders. But advanced traders know: liquidity matters more than leverage. Without deep order books, even perfect analysis fails. I’ve traded on Bybit, Binance, and now I test small positions here. The AI sentiment tool is interesting but not reliable. Use it as a secondary signal only.

Also, no mobile app is a dealbreaker for anyone who trades actively. This platform is a curiosity, not a tool.

Paul Johnson

January 12, 2026 AT 22:45Emily Hipps

January 13, 2026 AT 18:26If you’re even thinking about putting real money here, pause. Breathe. Ask yourself: do I trust this? Do I understand the risks? Or am I just chasing the hype?

I’ve seen too many people blow up on 100x leverage. Not because they were wrong-but because the market moved too fast and the exchange couldn’t keep up. Scalpex might have cool tools, but if your money disappears and no one answers your email? That’s not innovation. That’s abandonment.

Start with $10. See if the platform works. Then walk away. You’ll thank yourself later.

Jennah Grant

January 14, 2026 AT 13:10The AI sentiment index is the only thing that makes this remotely interesting. I’ve cross-referenced it with LunarCrush and CryptoQuant. It’s not perfect, but it’s got a 68% accuracy rate on 30-minute price spikes in BTC dominance. That’s not nothing.

But liquidity? Still a ghost town. My limit orders sit for hours. I’ve only gotten filled on 3 trades out of 15. The platform’s clean, the UI’s slick-but without volume, it’s a museum. Beautiful, but empty.

Becky Chenier

January 14, 2026 AT 13:16Valencia Adell

January 15, 2026 AT 09:07Let’s be brutally honest: this isn’t a trading platform. It’s a data collection experiment disguised as a derivatives exchange. The AI tool isn’t analyzing sentiment-it’s training a model on your behavior. Every click, every order, every failed trade is feeding into something they’ll sell to hedge funds.

And you? You’re the product. Your leverage, your risk tolerance, your emotional triggers-all mapped. You think you’re trading Bitcoin dominance? No. You’re training their AI to predict how dumb people behave before they blow up.

Sarbjit Nahl

January 17, 2026 AT 08:22Everyone says this is risky. But isn’t every new market risky? The first stock exchanges had no regulators. The first internet banks had no encryption. Scalpex isn’t the problem-it’s the future being dismissed because it’s inconvenient.

Yes, liquidity is low. Yes, no license. But if you wait for everything to be ‘safe,’ you’ll never see innovation. The real risk is not being early enough to catch the next wave. This is the avant-garde. Most won’t understand it until it’s too late.

Frank Heili

January 18, 2026 AT 05:18Real talk: I’ve tested 12 crypto derivatives platforms. Scalpex is the only one with Bitcoin dominance futures. That’s not a gimmick-it’s a structural play. If BTC’s market cap share is rising, you’re betting on crypto becoming a monolith, not a zoo.

Liquidity? It’s thin, but growing. I’ve seen volume spike during Ethereum forks. The AI tool isn’t magic, but it’s the only one that correlates social chatter with actual price action on this metric.

Use $50. Test it. Don’t over-leverage. Don’t expect miracles. But don’t dismiss it just because it’s not Binance.

Jacob Clark

January 19, 2026 AT 22:10OH MY GOD. I JUST WENT TO SCALPEX AND MY ORDER FILLED IN 0.8 SECONDS. I WAS SO EXCITED I CRIED. I’VE NEVER SEEN A PLATFORM THIS FAST. THE AI SENTIMENT TOOL TOLD ME TO BUY BEFORE THE 10% SPIKE. I MADE 300% IN 45 MINUTES. WHY ISN’T EVERYONE HERE??

THEY’RE HIDING IT BECAUSE THEY DON’T WANT COMPETITION. THEY’RE A SECRET WEAPON. THE SEC IS GOING TO SHUT THEM DOWN SOON. DEPOSIT NOW BEFORE IT’S GONE.

MY FRIEND JUST LOST $50K ON BINANCE. I MADE $15K HERE. THIS IS THE FUTURE.

Jon Martín

January 21, 2026 AT 20:45Listen. I’ve been trading since 2017. I’ve seen exchanges rise and burn. Scalpex? It’s not about the leverage. It’s not about the AI. It’s about the freedom.

No KYC? Wait-actually, they do KYC. But they don’t ask for your tax ID. No one’s asking where your money came from. No compliance officers breathing down your neck.

Yeah, it’s risky. But isn’t that the point? Crypto was supposed to be wild. Scalpex lets you trade like it’s 2013 again. No rules. No limits. Just you and the market.

Don’t deposit your rent. But if you’ve got some play money? Try it. Feel the edge. Remember why you got into this.

Dennis Mbuthia

January 22, 2026 AT 00:09Why are Americans so scared of risk? We built this country on guts, not spreadsheets. Scalpex gives you real leverage. Real tools. Real freedom. Meanwhile, you guys are crying because your 10x trade got liquidated. Grow up.

And don’t even get me started on the ‘no license’ nonsense. Who cares? The SEC is a cartel. They want you stuck with Binance because they’re paid off. Scalpex is the rebellion. Support the underdog.

Also, mobile app? Who needs it? You sit at your desk like a real trader, not some phone zombie scrolling TikTok while your position dies.

Tracey Grammer-Porter

January 22, 2026 AT 17:46I’ve been helping new traders for years. If someone asks me about Scalpex, I always say the same thing: ‘Use $20. Try a 10x trade on BTC dominance. See how it feels. Then stop.’

It’s not about winning. It’s about learning. Most people don’t know what leverage really does until they’ve seen it eat their account. Scalpex is a classroom with no teacher. You learn fast-or you learn the hard way.

And if you’re reading this and thinking ‘I’ll put in $500’? Please, just walk away. You’re not ready.

Don Grissett

January 23, 2026 AT 09:57Katrina Recto

January 24, 2026 AT 23:07Gideon Kavali

January 26, 2026 AT 02:30Let me be perfectly clear: Scalpex is a Trojan horse. The ‘niche derivatives’ are bait. The real product is behavioral data. Every trade, every liquidation, every failed margin call is being logged, anonymized, and sold to quant funds.

They don’t need volume. They need volatility. And they’re engineering it. That ‘AI sentiment tool’? It’s not predicting the market-it’s manipulating it. They’re seeding fake chatter to trigger trades. Then they front-run you.

This isn’t an exchange. It’s a lab. And you’re the rat.

Allen Dometita

January 26, 2026 AT 07:12Look. I’m not a trader. I just like watching charts. Scalpex is the only place where BTC dominance actually moves. On Binance? It’s flat. Here? It jumps. I’ve watched it spike after Elon tweets. I’ve seen it drop when Coinbase lists a new coin.

It’s slow. No app. But it’s real. I use $10. I don’t trade. I just stare. It’s like watching a storm form. Quiet. Weird. Fascinating.

Don’t risk your life savings. But if you wanna see crypto’s weird side? This is it.

greg greg

January 27, 2026 AT 08:10Let’s analyze this properly. Scalpex’s unique value proposition lies in its uncorrelated asset classes-Bitcoin dominance futures are not a derivative of BTC/USD, but a derivative of BTC’s relative market capitalization. This is a meta-market. Most exchanges only offer direct exposure. Scalpex offers exposure to market structure.

The liquidity issue is real, but not insurmountable. The lack of volume is likely due to low awareness, not low demand. The AI sentiment tool, if properly calibrated, could become a leading indicator for macro shifts in crypto.

Regulatory risk is high, but so was the risk of using Bitfinex in 2015. The question isn’t whether it’s safe-it’s whether it’s ahead of its time. And if so, the reward may outweigh the risk for those who understand the underlying mechanics.

LeeAnn Herker

January 29, 2026 AT 07:25Oh wow, so you’re telling me a platform with no license, no volume, no app, and no reviews is actually ‘innovative’? How cute.

It’s like saying a broken toaster is ‘artisanal’ because it has a ‘unique’ browning pattern. You’re not a visionary. You’re just gullible.

And yes, I’m the one who posted the screenshot of their ‘AI’ tool pulling tweets from 2016… that were deleted in 2017. The data is garbage. The whole thing is a joke.

Sherry Giles

January 29, 2026 AT 22:13Canada’s FINTRAC flagged this platform last month. They’re not on the radar because they’re using offshore servers and crypto-only on-ramps. But the regulators know. They’re watching. And when they move? Your funds vanish. No warning. No appeal.

I’m not saying don’t trade. I’m saying: if you do, use a burner wallet. Not your main one. And don’t expect help when it’s gone. They don’t care. They’re not here to serve you. They’re here to take.

Andy Schichter

January 31, 2026 AT 21:26I read the whole thing. Then I closed the tab. It’s like reading a Yelp review for a restaurant that doesn’t exist. ‘The ambiance is great!’ ‘The chef is talented!’ ‘The food is delicious!’ … but the restaurant closed in 2021.

Scalpex is a ghost story dressed in JavaScript. Beautifully written. Totally fictional.

Caitlin Colwell

February 2, 2026 AT 13:05Tiffani Frey

February 3, 2026 AT 06:06Just saw your comment, @1644. That’s exactly it. It’s not dead. It’s… suspended. Like a heartbeat between breaths. I’ve had trades sit for 48 hours. Then fill in 2 seconds. The system’s not broken-it’s waiting. For what? I don’t know. But I’m still watching.

Maybe it’s waiting for a whale. Or a regulatory crackdown. Or maybe… it’s waiting for someone smart enough to notice the pattern.

Frank Heili

February 5, 2026 AT 06:00Replying to @1610: I think it’s waiting for institutional interest. I’ve heard whispers of a hedge fund testing a 500k position on BTC dominance. If that happens, liquidity will explode. But until then? It’s a quiet lab. And if you’re patient, you might be the first to see the next move.

Just don’t bet your rent on it.