Escodex Fee Calculator

Your Savings

$0.00

If you already own some crypto and are hunting for a place to trade without paying a fortune, you’ve probably heard the name Escodex a decentralized exchange built on the BitShares blockchain that markets itself as a low‑fee platform for crypto‑savvy traders. Below is a no‑fluff, Escodex review that walks you through what the platform does, who it’s best for, and where it falls short.

What Sets Escodex Apart?

Most exchanges charge a tiered maker‑taker fee that changes with your 30‑day volume. Escodex throws that model out the window and applies a flat 0.10% fee to every trade, regardless of whether you’re a market maker or taker. That single‑rate approach simplifies cost‑calculation and, at today’s market rates, is roughly half the global average of 0.25%.

Fee Structure - The Numbers You Need to Know

Here’s a quick snapshot of how Escodex’s fees compare to the industry baseline:

| Fee Type | Escodex | Industry Avg. |

|---|---|---|

| Trading Fee (all users) | 0.10% | 0.25% |

| Bitcoin Withdrawal | ≈0.000014 BTC (network fee only) | ≈0.0008 BTC |

| Other Crypto Withdrawal | Network fee only | Variable, often higher |

Because Escodex only passes on the native network fee, you’ll rarely see additional costs when pulling funds off the platform. For high‑frequency traders or anyone moving large sums, the cumulative savings can be significant.

Withdrawal Costs - Why Network Fees Matter

Escodex runs on the BitShares fee protocol, which charges a flat 0.104 BTS for any on‑chain move. In Bitcoin terms that works out to roughly 0.000014 BTC, a fraction of what most centralized exchanges charge. The platform does not tack on any extra “platform fee,” so the amount you see on the blockchain explorer is the exact amount you pay.

No Fiat Gateways - What That Means for You

The biggest hurdle is the lack of fiat on‑ramps. You can’t deposit USD, EUR, NZD, or any government‑issued money directly into Escodex. The exchange assumes you already hold crypto somewhere else and want a cheaper venue to trade it. If you’re a newcomer who needs to buy your first Bitcoin, you’ll have to start on a fiat‑friendly exchange like Coinbase, Kraken, or a local NZ platform, then transfer the assets to Escodex for lower‑cost swaps.

Technical Backbone - BitShares and DPoS

Escodex inherits everything from its parent blockchain, BitShares a DPoS‑based public ledger designed for decentralized financial services and exchanges. BitShares uses Delegated Proof of Stake (DPoS), where a small set of elected witnesses produce blocks, achieving high throughput and low latency. Those characteristics translate into fast order matching and almost instant deposits/withdrawals on Escodex.

Who Should Consider Escodex?

- Experienced crypto traders who already own a diversified portfolio and want to shave off fees on frequent swaps.

- High‑volume movers who trade large positions and can benefit from the flat‑rate model.

- Anyone comfortable managing their own private keys, since the platform is decentralized and you retain custody of funds.

If you’re just getting started, the fiat barrier may make Escodex a second‑step platform rather than your first stop.

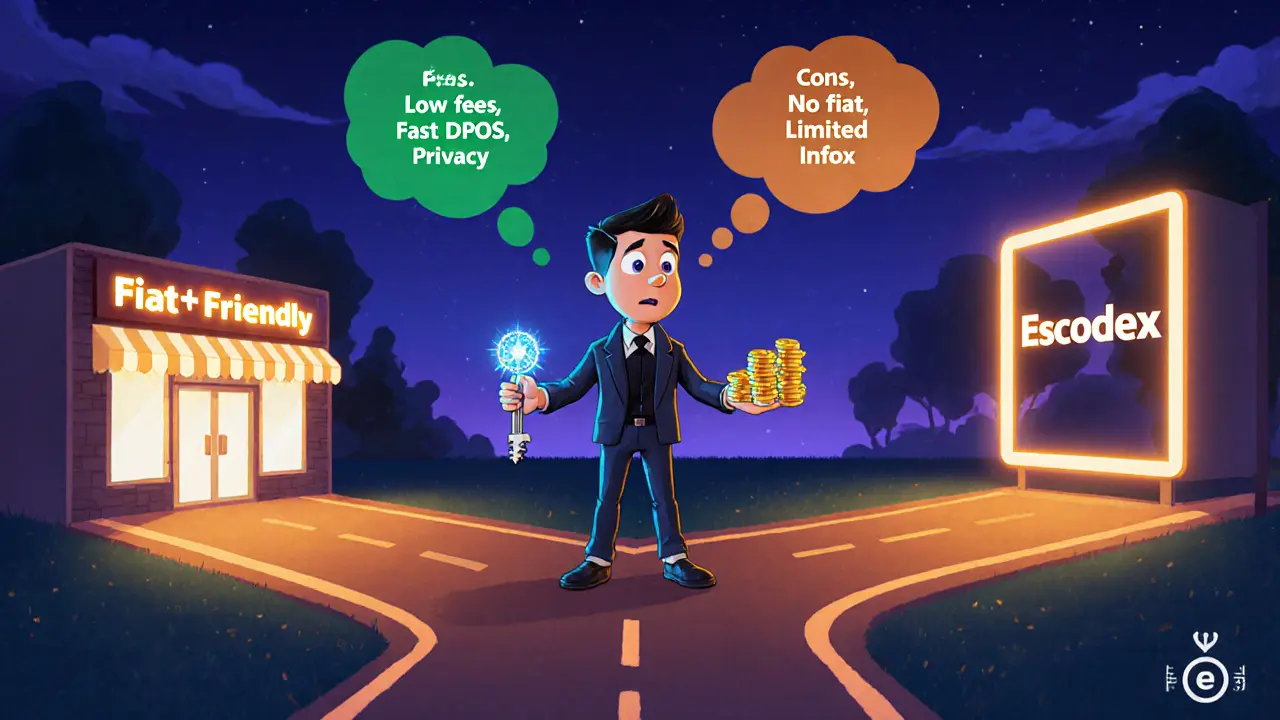

Pros and Cons - A Quick Checklist

- Pros:

- Flat 0.10% trading fee - simple and cheap.

- Network‑only withdrawal fees - among the lowest in the market.

- Built on BitShares DPoS - fast and reliable.

- No KYC for basic trading, preserving privacy.

- Cons:

- No fiat deposits - limits accessibility for newcomers.

- Limited public information on security audits, insurance, and regulatory status.

- User‑interface details and mobile app availability are sparse.

- API documentation is minimal, which may deter algorithmic traders.

How to Get Started on Escodex - Step‑by‑Step

- Acquire crypto on a fiat‑friendly exchange (e.g., Binance, Kraken, or a local NZ platform).

- Send the assets to a personal wallet that supports BitShares tokens (e.g., BitShares‑wallet or a hardware wallet with BTS support).

- Visit Escodex’s web portal and click “Connect Wallet.” Choose your wallet type and authorize the connection.

- Deposit the supported crypto (BTC, ETH, BTS, etc.) into the Escodex smart contract. The transaction will be processed instantly thanks to BitShares’ DPoS consensus.

- Navigate to the trading interface, select a pair (e.g., BTC/BTS), and place a market or limit order. Remember, the fee will be 0.10% of the trade value.

- When you’re ready to withdraw, click “Withdraw,” choose the target address, and confirm. Only the network fee will be charged.

All of these steps happen without a central custodian holding your keys, which is the core security promise of a decentralized exchange.

Security & Trust - What We Know, What’s Missing

Escodex’s security largely mirrors BitShares: the blockchain’s DPoS model is resistant to 51% attacks because consensus is delegated to a small, vetted set of witnesses. However, the platform’s public documentation does not detail independent security audits, insurance coverage for user funds, or any history of breaches. This opacity makes it harder to gauge long‑term risk, especially for large holders.

Best practice: keep only the amount you plan to trade on Escodex and store the bulk of your holdings in a hardware wallet. Regularly review community forums (Reddit’s r/CryptoCurrency, BitShares Discord) for any emerging security concerns.

Final Verdict - Is Escodex Worth Your Time?

For traders who prize low fees and already have crypto on hand, Escodex offers a compelling, privacy‑friendly option. The flat‑rate model removes the guessing game around volume tiers, and the BitShares backbone ensures fast, low‑cost transactions.

On the flip side, the fiat dead‑end and the lack of publicly verified security credentials keep the exchange in a niche corner of the market. If you’re comfortable handling your own deposits and withdrawals, and you can source crypto elsewhere, give Escodex a spin for the fee savings. Otherwise, start with a more mainstream platform that supports fiat and consider Escodex as a secondary, cost‑efficiency tool.

Frequently Asked Questions

Can I buy Bitcoin directly on Escodex?

No. Escodex does not support fiat deposits or direct purchases. You need to bring in Bitcoin or another supported crypto from an external wallet.

What is the exact trading fee?

A flat 0.10% is charged on every trade, no matter the size, pair, or whether you’re a maker or taker.

Are my funds insured on Escodex?

The platform does not publish any insurance policy. Since it’s a decentralized exchange, funds remain in your wallet, not on a custodial balance.

How fast are withdrawals?

Withdrawals are limited to the underlying blockchain’s confirmation speed. For Bitcoin, expect 10‑20 minutes; for BitShares‑based tokens, confirmations are usually under a minute.

Is there an API for bots?

Escodex offers a basic public API, but documentation is sparse. Advanced algorithmic traders may need to build custom wrappers or consider a more API‑rich exchange.

Marina Campenni

October 18, 2025 AT 08:21I understand the appeal of the flat 0.10% fee, but the lack of fiat on‑ramps can deter newcomers who haven’t yet built a crypto portfolio.

Irish Mae Lariosa

October 21, 2025 AT 19:41The fee structure is undeniably attractive for high‑volume traders, yet the platform’s overall utility is hampered by several critical shortcomings. First, the absence of fiat deposits forces users to maintain an external wallet, which adds an extra step and potential point of failure. Second, the documentation surrounding security audits is sparse, leaving large holders with unanswered questions about risk exposure. Third, the user interface feels under‑developed, offering limited charting tools compared to mainstream DEXs. Fourth, API support is minimal, which could discourage algorithmic trading strategies that rely on robust endpoints. Fifth, while the flat fee is low, network fees on Bitcoin remain non‑trivial during periods of congestion, eroding some of the savings. Sixth, the reliance on BitShares DPoS introduces a centralisation vector through elected witnesses, a factor that some privacy‑focused users may find unsettling. Seventh, there is no insurance coverage disclosed, meaning users must fully trust the decentralized architecture. Eighth, customer support channels appear limited to community forums, which may not suffice for urgent issues. Ninth, the platform’s liquidity depth varies across pairs, potentially leading to slippage on larger orders. Tenth, the onboarding process assumes a level of technical proficiency that could alienate less experienced participants. Eleventh, the lack of mobile applications restricts trading on the go, a feature increasingly expected in today’s market. Twelfth, the platform’s governance model is not transparent, leaving stakeholders uncertain about future fee adjustments. Thirteenth, cross‑chain compatibility is limited, restricting diversification opportunities. Fourteenth, the overall branding and marketing appear under‑invested, which may affect adoption rates. Finally, despite the low fee claim, users must still account for hidden costs such as gas fees and potential exchange rate spreads, which cumulatively diminish the purported advantage.

Nick O'Connor

October 25, 2025 AT 07:01Escodex offers a flat 0.10% rate, which, in theory, simplifies cost calculations, yet the platform’s limited fiat support, sparse API documentation, and modest liquidity pools could pose significant challenges for many traders.

Deborah de Beurs

October 28, 2025 AT 17:21Listen up: if you think a low fee makes up for the complete absence of any fiat gateway, you’re living in a fantasy world. The platform pretends to be “decentralized freedom,” but you still need to jump through hoops elsewhere just to get on board. That’s not a feature, that’s a flaw, and it’s enough to make most users roll their eyes before they even log in.

Sara Stewart

November 1, 2025 AT 04:41While the fee model is indeed competitive, integrating escrow services or partnering with fiat on‑ramps could dramatically broaden the user base; leveraging existing liquidity providers would also mitigate the depth issues you highlighted.

Laura Hoch

November 4, 2025 AT 16:01The philosophical trade‑off here is clear: you gain privacy and low fees at the expense of accessibility; traders must decide whether the marginal savings outweigh the cognitive load of managing separate wallets and external exchanges.

Devi Jaga

November 8, 2025 AT 03:21Oh sure, because adding fiat would somehow make the universe more decentralized – how delightfully contradictory.

Deepak Kumar

November 11, 2025 AT 14:41If you’re comfortable handling your own keys, give Escodex a try; the flat fee can really add up on frequent swaps, and the BitShares backbone ensures fast confirmations.

Matthew Theuma

November 15, 2025 AT 02:01Sounds good 👍 but remember the Bitcoin withdrawal time can still be 10‑20 mins, so plan accordingly.

Carolyn Pritchett

November 18, 2025 AT 13:21Honestly, the whole thing feels like a half‑baked hobby project; without proper audits and insurance, it’s a risky playground for anyone with serious capital.

Miguel Terán

November 22, 2025 AT 00:41The criticism is valid yet overlooks the fact that many niche DEXs operate under similar constraints and still manage to attract a dedicated community; the key is transparency and incremental improvements, not perfection from day one.

Shivani Chauhan

November 25, 2025 AT 12:01Indeed, incremental progress combined with clearer security disclosures could bolster confidence among larger traders.

Ikenna Okonkwo

November 28, 2025 AT 23:21Overall, Escodex offers a promising low‑fee solution for experienced users, and with continued community feedback, it can evolve into a more inclusive platform.