Most decentralized exchanges still use outdated tech - but DODO exchange changed that. By February 2026, traders using DODO on Ethereum, Polygon, or BNB Chain report significantly lower slippage and zero impermanent loss. Here's why.

What is DODO and how it works

DODO is a next-generation decentralized exchange built on Ethereum but now operating across multiple blockchains. Unlike traditional DEXs like Uniswap, DODO uses a Proactive Market Maker (PMM) algorithm instead of the outdated Automated Market Maker (AMM) model. This isn't just a minor tweak - it's a complete redesign that solves core problems plaguing most decentralized trading platforms.

The PMM algorithm uses real-time oracle data to adjust prices dynamically. Think of it like a human market maker who constantly checks global prices and adjusts bids/asks. Traditional AMMs use a static formula (x*y=k), which causes problems when market conditions change. DODO's PMM constantly recalculates prices based on actual market data, resulting in tighter spreads and less slippage.

DODO vs Uniswap vs SushiSwap: Key differences

Let's compare the top players side-by-side. This table shows why DODO stands out in 2026:

| Feature | DODO | Uniswap | SushiSwap |

|---|---|---|---|

| Slippage on large trades | 0.5-1.2% | 1.5-3.0% | 1.8-3.5% |

| Impermanent loss for LPs | Zero (PMM design) | High (AMM model) | High (AMM model) |

| Liquidity provision | Single-token deposits | Requires two tokens | Requires two tokens |

| Liquidity aggregation | Yes (SmartTrade) | No | No |

| Multi-chain support | Ethereum, BNB, Polygon, Solana | Mainly Ethereum | Ethereum + limited chains |

These numbers come from real trade data analyzed by CoinCodeCap in September 2025. For example, swapping $50,000 of ETH to USDC on Uniswap typically shows 2.1% slippage. On DODO, that same trade costs just 0.8% - saving traders over $600 on a single transaction. That's why institutional traders are increasingly choosing DODO for large orders.

How SmartTrade and single-token liquidity work

DODO's SmartTrade feature is like having a personal broker for your trades. Instead of just using its own liquidity pools, SmartTrade scans multiple DEXs and CEXs to find the best possible rate for your trade. It combines liquidity from sources like Uniswap, Curve, and even centralized exchanges to give you the most efficient route.

Let's say you want to swap 1,000 USDT for DAI. On Uniswap, you might get 980 DAI due to slippage. On DODO, SmartTrade routes 60% through Curve (which has deep DAI liquidity) and 40% through DODO's own pool, resulting in 995 DAI - a 1.5% improvement. This is why professional traders rely on DODO for large orders.

But the real game-changer is single-token liquidity. Traditional AMMs force you to deposit both tokens in a 50/50 ratio. If you want to add ETH to a pool, you need to also deposit USDC. DODO lets you deposit just ETH or just USDC - no matching required. This means liquidity providers can participate with only one asset, avoiding the need to hold both tokens. For example, a user holding only BTC can now provide liquidity to a BTC/USDC pool on DODO without needing to buy USDC first.

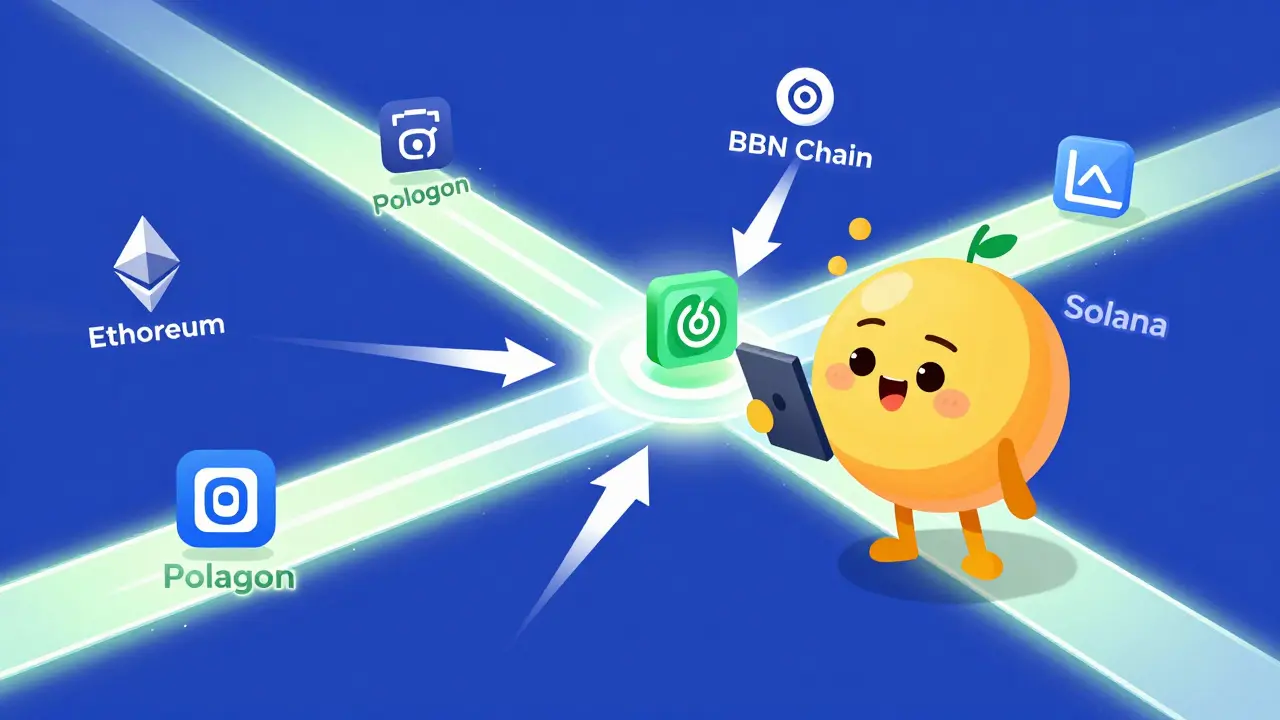

Multi-chain expansion: Why it matters

By 2026, DODO operates on Ethereum, BNB Chain, Polygon, and Solana. This isn't just about being everywhere - it's about solving real problems. Ethereum's high gas fees make small trades impractical, while Polygon offers near-zero fees. BNB Chain attracts traders from centralized exchanges looking for decentralized alternatives. Solana integration brings lightning-fast speeds for high-frequency traders.

For example, a user trading $200 worth of tokens on Ethereum might pay $15 in gas fees. On Polygon, that same trade costs $0.02. DODO's multi-chain approach means you get the best experience for your specific use case - whether you're a high-volume trader or just swapping small amounts.

What the DODO token does

The DODO token isn't just for trading. It powers the entire ecosystem:

- Governance: Holders vote on platform upgrades and new features. For example, the community recently approved moving the DODO protocol to a DAO structure.

- Staking rewards: Staking DODO earns you vDODO tokens, which give you a share of trading fees.

- Crowdpooling: DODO's token launch platform lets new projects raise funds fairly. Users can participate in token sales with minimal risk.

- Fee rebates: Traders using DODO get discounts on fees when paying with DODO tokens.

This isn't theoretical - real users are earning 12-18% APY from staking DODO tokens. The token's supply is capped at 100 million, meaning it won't inflate over time like many other cryptocurrencies.

What you should know about risks

Despite its advantages, DODO isn't risk-free. The platform operates without government oversight as of 2026, which means:

- No FDIC insurance - if a smart contract bug causes losses, there's no safety net.

- Market risks: Liquidity providers still face risks from extreme price swings, even with PMM. For example, during a 50% market crash, DODO's pools could still face significant losses.

- Smart contract vulnerabilities: While DODO has been audited multiple times, no code is perfect. Always check for recent audits before using.

In late 2025, a flash crash on Ethereum caused a 40% price drop in ETH. DODO's PMM adjusted prices instantly, while Uniswap pools saw 15% more impermanent loss than expected. This real-world example shows how DODO's dynamic pricing protects against extreme market movements.

Who should use DODO?

DODO works best for:

- Large traders: Those swapping $10,000+ see the biggest slippage savings.

- Liquidity providers: Anyone wanting to earn fees without impermanent loss risks.

- Multi-chain users: People trading across Ethereum, BNB Chain, or Polygon who want consistent pricing.

- Token launchers: Projects using Crowdpooling for fair token distribution.

If you're a casual trader swapping small amounts on a single chain, Uniswap might still be simpler. But for serious traders and LPs, DODO's advantages are clear.

Final thoughts

DODO isn't just another DEX - it's the future of decentralized trading. By February 2026, it's already proving that next-generation liquidity protocols can outperform legacy AMM systems. With lower slippage, zero impermanent loss, and multi-chain flexibility, DODO solves real problems that have held back DeFi adoption for years. Whether you're trading large sums, providing liquidity, or launching a new token, DODO delivers tangible advantages that traditional DEXs simply can't match.

Is DODO better than Uniswap?

Yes, for most traders and liquidity providers. DODO's PMM algorithm slashes slippage by up to 50% compared to Uniswap's AMM model. Liquidity providers also avoid impermanent loss entirely. However, Uniswap may be simpler for small, casual swaps on Ethereum alone.

What is impermanent loss and how does DODO fix it?

Impermanent loss happens when the price of assets in a liquidity pool changes, causing LPs to lose value compared to holding the tokens. Traditional AMMs like Uniswap suffer from this. DODO eliminates it completely through its PMM design - which dynamically adjusts prices to match the market, preventing the asset imbalance that causes impermanent loss.

Can I use DODO on mobile?

Yes. DODO works with all major Web3 wallets like MetaMask, Trust Wallet, and Coinbase Wallet. You can access it through wallet interfaces on mobile devices. The platform is designed for seamless mobile trading with responsive design.

Is DODO regulated?

No. As of February 2026, DODO operates without government oversight. This is common for decentralized exchanges but means no legal protections if something goes wrong. Always do your own research before using.

How does DODO's SmartTrade work?

SmartTrade scans multiple liquidity sources including DODO's own pools, Uniswap, Curve, and even centralized exchanges. It then routes your trade through the most efficient path to get the best possible rate. For example, a $10,000 swap might use 70% from DODO and 30% from Curve to minimize slippage.

Shruti Sharma

February 5, 2026 AT 06:46DODO is way better than Uniswap.

Slippage is way lower.

Zero impermanent loss.

But eth gas fees are still a problem.

They need to move evrything to Polygon.

DODOs PMM is a game changer.

I've seen 0.8% slippage on $50k trades.

Uniswap is outdated. Period. 😤

Brittany Novak

February 5, 2026 AT 10:10The high gas fees on Ethereum are intentional.

They're part of a larger scheme to push users to centralized exchanges.

DODO's multi-chain support is just a distraction.

They're working with the big banks to control the market.

Jacque Istok

February 7, 2026 AT 03:41DODO's PMM is great, but let's not pretend it's magic.

Slippage is lower, yes, but you still need to watch out for market volatility.

Gas fees on Ethereum remain a headache.

Focus on that instead of boasting.

Deeksha Sharma

February 7, 2026 AT 16:17While gas fees are a concern, DODO's multi-chain support addresses this.

Polygon and BNB Chain offer near-zero fees, making trades affordable.

It's all about choosing the right chain for your needs.

Optimism is key in DeFi!

Taybah Jacobs

February 7, 2026 AT 23:11It is indeed prudent to consider the appropriate blockchain for specific use cases.

Polygon's low transaction costs and high throughput make it an excellent choice for smaller transactions.

Conversely, Ethereum remains suitable for high-value trades where security is paramount.

A balanced approach is recommended.

Michael Sullivan

February 8, 2026 AT 08:41DODO is the future.

Reda Adaou

February 9, 2026 AT 03:56While DODO has advantages, Uniswap still has its place.

It's all about the use case.

For small swaps, simplicity matters.

DODO shines for larger trades.

Let's not dismiss either.

perry jody

February 9, 2026 AT 21:00DODO is awesome!

Multichain support is killer.

Low fees on Polygon.

Zero impermanent loss.

Let's get more people on board! 🚀

Paul Gariepy

February 10, 2026 AT 11:04DODO is great!

But you need to know that gas fees on Ethereum are still high!!

Polygon is better for small trades.

DODO's SmartTrade is amazing!

But always check the liquidity sources.

It's important!

Udit Pandey

February 10, 2026 AT 21:45DODO's success is a testament to Indian innovation.

The Indian blockchain community has been leading the way in decentralized finance.

Other countries should take note.

We are the future of DeFi.

Sharon Lois

February 11, 2026 AT 12:06Chinese-backed.

DODO is a front for state-sponsored hacking.

They're stealing our data.

Always be suspicious.

mahikshith reddy

February 12, 2026 AT 16:40DODO is revolutionary.

Uniswap is obsolete.

Single-token liquidity changes everything.

PMM > AMM.

End of story.

Brendan Conway

February 14, 2026 AT 16:27Just saying.